Big Tech Has Sneaky Agenda in Quest to Regulate Privacy

To protect privacy, activists and politicians are clamoring to regulate big tech.

They don’t know it yet, but they are falling into a trap. That’s because big tech is embracing oversight.

In a corporate blog post Feb. 7, Michael Punke, vice president for global public policy at Amazon Web Services, advocated for legislative guidelines in the use of artificially intelligent facial-recognition software.

This was a major tell, and an opportunity for investors.

It may look like tech leaders simply waking to the new reality. The Wild West era of moving fast and breaking things is over. New sheriffs will restore law and order. Happy times.

These are all warm thoughts. But no, that’s not it.

In haughty corporate boardrooms in Silicon Valley and Seattle, tech executives are planning to carve up big slices of the future of all commerce.

The truth is, they are not so much embracing oversight, as they are building walls to keep nimble disruptors away. They are turning big tech into big pharma. They are forging sprawling oligopolies, fortified by well-intentioned politicos and pundits.

The AWS pleas for regulation follow a similar request from Microsoft (MSFT) in December 2018. According to a Wired report, Redmond executives argued AI facial-recognition technologies, if left unchecked, could quickly spiral into a rampant privacy violations and new forms of discrimination.

The AI technologies Amazon, Microsoft and Google are building walls around, are being weaved into the fabric of future commerce. Regulations keep out potentially formidable future competitors.

This is not the first time regulators found big tech unexpectedly supine. Back in 2016, the European parliament adopted the General Data Protection Regulation, a legal framework requiring businesses to protect personal data.

When Věra Jourová, the European Union justice commissioner, traveled to meet with representatives from Alphabet (GOOGL) and Facebook (FB), she expected them to be nervous. Instead, “They were more relaxed, and I became more nervous,” she told The Wall Street Journal.

Six months after the GDPR went into effect, a Politico story showed Facebook and Google were more dominant than ever across the EU. Investment in European startups fell a staggering 40%. Market share for smaller advertising firms collapsed by 30%.

It makes sense. In the run-up to the GDPR, Politico notes the Fortune Global 500 firms spent $7.8 billion for compliance. For fledgling firms, the cost of admission is simply too high.

In the court of public opinion, facial-recognition AI is far more toxic than ad-tracking software.

Big tech is happy to play to that fear.

While AWS and Microsoft managers make the case that legislative oversight will lead to healthy market competition, regulation is likely to impose costly new barriers that prohibit competition. Only the well-heeled will survive.

Make no mistake, that is what big tech wants. And the prize is unimaginably big.

The AI technologies Amazon, Microsoft and Google are building walls around, are being weaved into the fabric of future commerce. They will help computers see, hear, touch and ultimately learn.

McKinsey and Co., a global management consulting firm, found hundreds of AI use cases. Inexpensive sensors, and data analytics will help companies predict maintenance and perfect logistics. For example, a European trucking company managed to cut fuel costs by 15% using AI to optimize routes, vehicle performance and driver behavior.

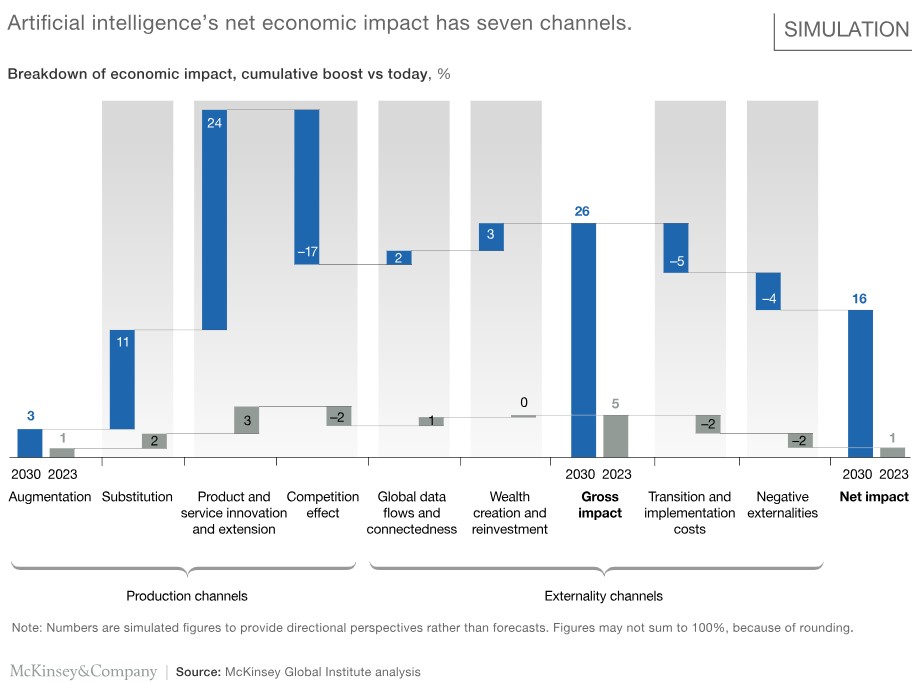

“Notes From the AI Frontier,” its September 2018 discussion paper, predicts these technologies could create up $5.8 trillion in value annually, and add $13 trillion to the global economy by 2030.

Big tech recognized the potential of AI long ago. Businesses were built solely to collect the data needed to train algorithms.

- Every time you ask Alexa about the weather or a sports score, Amazon is learning how to understand human speech and intonation.

- Every second, Google Maps is collecting real-time location data from a billion mobile devices. That information is being processed to build better logistics models.

With massive platforms, and a steady stream of data in hand, the next step is to build durable competitive advantages. And there is no better leg-up on garage innovators than government red tape.

Amazon is up 6% this year, and up 18.8% over the past year.

Many tech investors worry too much about regulation. They see only negative outcomes for big tech.

They’re misunderstanding the game being played. They should be asking why executives at the largest tech companies in the world are advocating oversight.

Amazon logged $233 billion in sales during fiscal 2018, an increase of 31% year over year. Longer-term investors should buy every meaningful decline. This is only the beginning of what is possible for big tech.

Best wishes,

Jon D. Markman