Gene Editing Advancement Emerges from the Lab

Editas Medicine, Inc. (Nasdaq: EDIT), CRISPR Therapeutics AG (Nasdaq: CRSP) and Intellia Therapeutics, Inc. (Nasdaq: NTLA) shot to new highs Monday.

That’s because, on Friday, Catherine Wood, the founder of ARK Investment Management, appeared on Bloomberg Television. After talking about her investment in Tesla, Inc. (Nasdaq: TSLA), she then said gene-editing might be an even bigger investment opportunity.

Buyers showed up on Monday with an appetite for her recommendations.

Longtime market watchers will say it is not supposed to be this way. Healthy markets are efficient, they will argue. One portfolio manager shouldn’t have so much influence.

That’s true … kind of.

But very few portfolio managers have had years comparable to Cathy Wood’s 2020.

The ARK Investment chieftain appeared on Bloomberg in the wake of Tesla being added to the Standard and Poor’s 500 after its sensational 2020 advance. Wood was a good interview choice. She has been a staunch Tesla bull from the start, even when most professionals were extremely skeptical.

What she correctly saw was a colossal business opportunity ahead, built on three paradigm shifting innovations: vehicle electrification, autonomy and self-driving taxicabs. Then, in February 2018, she predicted the share price would reach $4,000 for a market capitalization of $672 billion.

Related Post: Schrodinger Discovers Success

To suggest that she was in the minority opinion is a huge understatement. Television interviewers and pundits were incredulous, at best.

Keep in mind that since the time Tesla shares split five-for-one, the company has issued more shares to finance expansion, and the stock price has since rallied tenfold.

As Wood sat down for the Bloomberg interview Friday evening, Tesla’s market capitalization had risen to an astonishing $651 billion.

She could have used the interview to take a victory lap. Instead, she explained that investing in genomics and gene-editing stocks should be an even better longer-term investment than Tesla because the technology has the potential to cure disease. Specifically, she favored Editas, CRISPR Therapeutics and Intellia Therapeutics.

She’s probably right about that assessment. Healthcare is undergoing an important convergence with DNA sequencing and artificial intelligence.

In 2019, I described the promise of gene editing and these stocks extensively in my book Fast Forward Investing: How to Profit from AI, Driverless Vehicles, Gene Editing, Robotics and Other Technologies Reshaping Our Lives. (It makes a great Christmas present. Click here if you’re interested.)

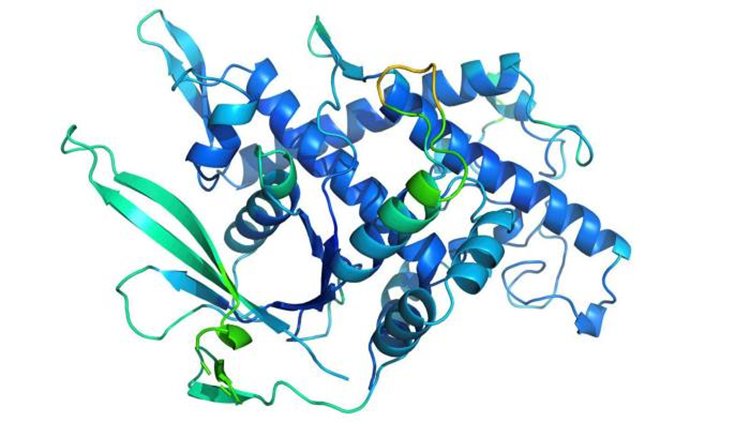

I also wrote about the subject as recently as last week when I discussed AlphaFold, an artificial intelligence project from DeepMind, which is a subsidiary of Alphabet Inc. (Nasdaq: GOOGL). The project was formed to find a solution to the protein folding problem. For 50 years, biologists have been stumped in their pursuit to understand why proteins take the shapes they do.

This is important because the 3D shapes of proteins define their function.

Scientists know how to manipulate amino acids, the building blocks for proteins. So, in theory, if they could predetermine the folding process, it should be possible to construct specific proteins for drug treatments to cure the cell mutations that cause disease.

AlphaFold solved this problem … and it’s a really big scientific breakthrough.

This innovation, in conjunction with DNA sequencing and gene editing, should lead to many novel drug treatments in short order.

Related Post: Small COVID-19 Test Maker Is Going Viral

Editas, CRSPR Therapeutics and Intellia Therapeutics own the majority of gene-editing technology intellectual property. Unfortunately, the companies have been mired in a series of cross litigations. Wood argues the best strategy going forward is cross-licensing for the sake of mankind.

Curing disease and competing technology companies coming together is a great story. Editas, CRISPR and Intellia hold great promise.

Investors with longer-term investment horizons can probably buy shares around current levels after the fever breaks a bit.

If you’d rather avoid single-stock risk, check out Woods’ exchange-traded fund ARK Genomic Revolution ETF (BATS: ARKG).

Best wishes,

Jon D. Markman