Google Cashes Out Smaller Rivals with Slick New Payment App

Google launched a sweeping redesign of its Pay mobile application Wednesday and it’s kind of big deal because it finally brings all of the company’s strengths to digital wallets.

The new Google Pay adds insights and search across payments, Gmail, Photos and bank/credit card statements if you opt in. The enticement is lots of rewards and a slick user interface available on both iPhones and Androids.

Competitors like PayPal Holdings, Inc. (Nasdaq: PYPL) and Square, Inc. (NYSE: SQ) should buckle up. It’s going to be a bumpy ride.

There are some caveats. Alphabet Inc. (Nasdaq: GOOGL), Google’s parent company, still makes the lion’s share of its sales from advertising. Some consumers may be turned off by the idea of surrendering personal financial data to an advertising company.

However, in a blog post, Google Pay product managers offer assurances no data will ever be sold to third parties, or even shared with Alphabet’s ad businesses.

Also, it turns out that most people actually do trust Google as a brand. Pay has 150 million users in 30 countries. And ad-supported services such as Gmail, Photos and of course Google Search, are among the most popular mobile apps.

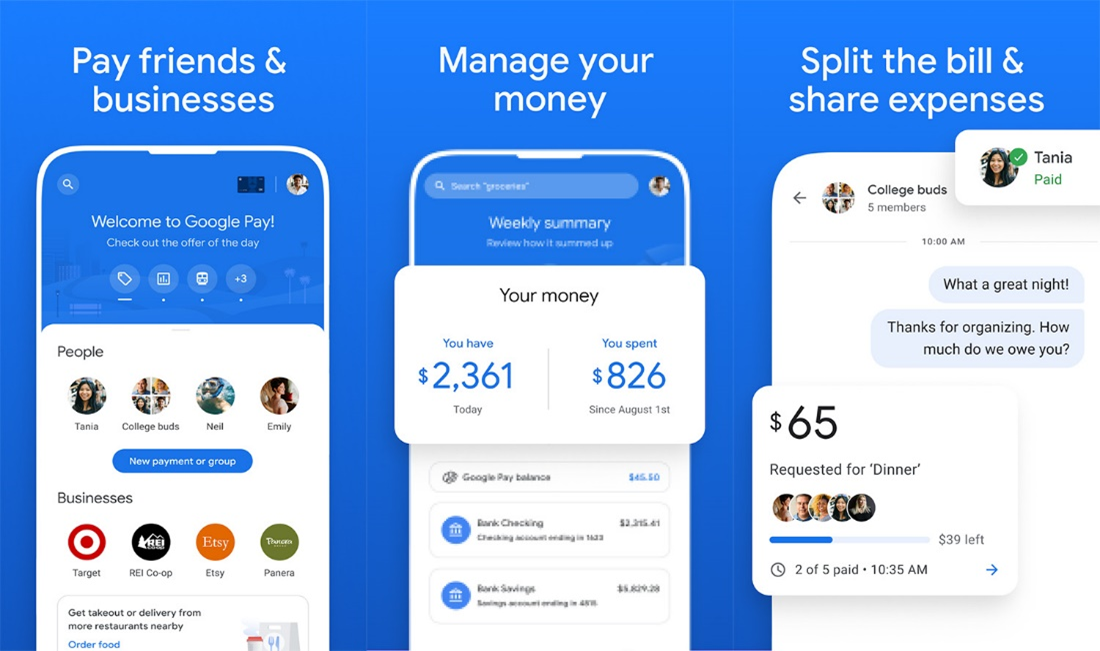

Google won over consumers with incredibly simple yet effective software. The new Pay app takes that clarity to the extreme.

For example, to pay a friend, just tap on their photo inside the app, add an amount and hit send. The transaction happens instantly while creating a private encrypted conversation. For group repayment, enter the amount, add the friends involved and hit send. The app contacts your buddies with a message requesting payment for their share. As they pay, their photos within Pay transform from ghosted to full color. Digital peer pressure is not subtle.

Droidlife.com

For businesses, the app automatically keeps track of the shops you frequently visit both in person and online. Like your friends, these relationships appear on the home screen. Tapping on business logo brings up your transactions, loyalty programs and rewards.

Related Post: Google Continues to Find Success

And this is where Pay gets very Googly.

Google software engineers have been able to bring a bunch of neat things completely inside of the Pay application. Product Manager Josh Woodward says users will be able to order food (and skip the lines) at 100,000 restaurants, check the price and buy gas at 30,000 stations and pay for parking in 400 cities without downloading other apps. And there are discounts and special offers, too.

Many of these goodies are in the Explore tab, a quick swipe left.

Google’s algorithm populates member rewards based on transactions. This means cash back and discounts from brands members already use. But what’s cool is the only interaction required is selecting the offer. Google Pay will automatically credit the reward when the item is purchased. There are no coupons to keep track of.

Ease of use is a big part of what made Google the most powerful software business of the internet era. The other part is finding relevant information quickly.

A swipe right in Pay brings up the Insights tab. This is full on Google Search, except for every financial transaction across time frames and uber-specific categories like pet food. The software uses algorithms to learn and automatically remind users about upcoming bills, or to nudge them to save more.

PayPal’s Venmo and Square’s Cash applications can do some of these tasks, but not all. Neither has access to Google’s trove of user data, nor do they have the scale.

Related post: Business is Booming for Zoom

A white paper from Ark Invest, an investment manager, estimated that monthly active users for both apps were at less than half that of Google Pay. It’s worth noting Apple, Inc. (Nasdaq: AAPL), Samsung and Walmart Inc. (NYSE: WMT) are investing heavily in digital wallets.

It’s also important to keep in mind that Alphabet has come under federal scrutiny for anticompetitive practices, which could potentially require the software maker to spin off or close down the Pay service.

And while this is not a zero-sum game, Ark analysts see digital wallets as an $800 billion opportunity. Thus, PayPal and Square investors should anticipate slower growth as bigger firms like Google ramp up more robust offerings.

Investors should continue to keep Google on their radar and use potential weakness as a buying opportunity.

Best wishes,

Jon D. Markman