Network Power is Migrating from the Cloud to the Edge

Cloud computing is so yesterday.

Forget blowout growth at Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOGL) and even IBM (IBM). The future of computing looks like the past, sort of.

Forrester Research, an international information technology research firm, warns that the coming sensor deluge makes large parts of cloud computing unrealistic.

It’s far more efficient and practical to process data where it is collected.

This is called “edge computing.” Data gets processed as close to the source as possible – the edge of the network – instead of in a massive, centralized data-storage warehouse.

And that opens up exciting new avenues for investors.

You can already see how process has been pushed to the edge of networks.

New iPhones use special chips to keep authentication data on the device, and off Apple (AAPL) servers. It’s a big privacy bonus. It should also keep Apple out of court when the Feds inevitably come calling for unlock codes.

Google uses its own custom chips for intricate machine learning. The new Pixel phones process image data directly on the device. The result is faster processing and the best photos from any smartphone.

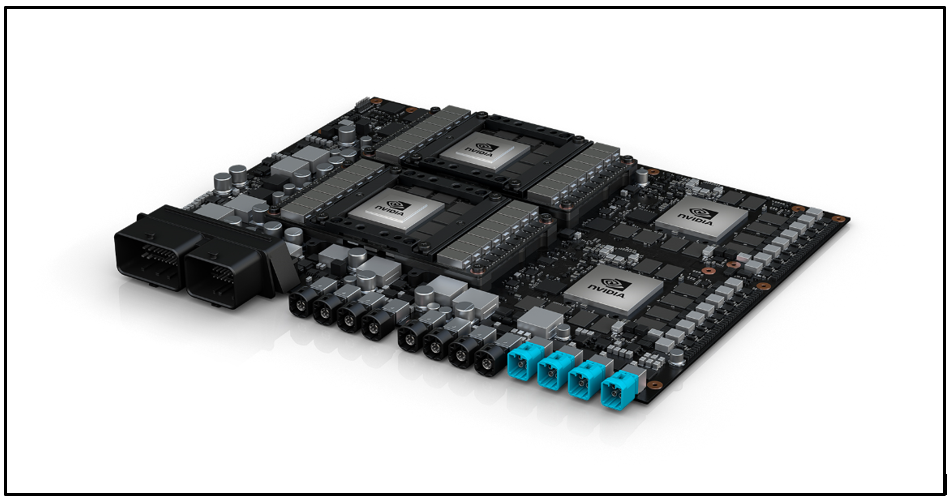

Nvidia (NVDA) is taking edge computing to the extreme. It makes high-end graphics hardware and artificial intelligence software platforms. Now it’s taking what it’s learned and building supercomputers for self-driving cars.

NVDA’s latest creation, the Drive PX Pegasus, is 13-times faster than the previous generation. Despite being the size of a license plate, it can process 320 million instructions per second. That’s more than enough oomph to handle inputs from lidar, radar, cameras and any other sensors found on a state-of-the-art autonomous vehicle.

The company claims it will bring full autonomy to vehicles in the second half of 2018. That’s less than a year from now.

For each of these applications, the common denominator is speed.

Reducing latency by a few seconds on a smartphone certainly improves the user experience. However, in a self-driving car, going 55 mph on a crowded road, those seconds could be the difference between life and death.

And there are many similar implementations. Think about fast-moving robotic arms in industrial factories, heavy machinery in mining pits or on oil rigs, or smart grids to manage traffic.

The irony is that before the cloud, most computing did take place at the edge of the network. It happened on beige Windows-based desktops. It also led to a giant new IT infrastructure.

Pushing computing back to the edge will be a repeat. Edge computing requires gateway servers, microdata centers, cloudlets and fog fabric nodes.

It’s something few investors are talking about. And that is the opportunity.

I’m not making the case today’s cloud-computing winners are headed for a reckoning.

I pointed my members to Amazon, Microsoft, Alphabet and Nvidia years ago on the basis they were strong companies with visionary leadership.

That is still true. They will adapt. In many cases, this is already happening with new architectures and partnerships.

However, as the Internet of Things evolves, the rise of edge computing becomes inevitable.

That’s why I’m telling my members now about a smaller company that uses fog computing to bring all of the benefits of the network closer to the edge.

In fog computing – aka fogging – network designers make sure data gets collected and analyzed at most efficient and logical places between the source and the cloud.

That way, less data gets transported back to the cloud for processing. Fogging’s faster and more efficient. So, the company is growing fast, too.

Another company is the premier builder of microdata centers. These standardized, pint-sized data centers are rack-level systems. But they have the power of their big brothers. And they can be deployed anywhere. It’s a market predicted to grow to $6.3 billion by 2020.

Another is a software-platform provider in hyper-growth mode.

The bottom-line: Information technology is constantly evolving. The best investors keep their eyes open, looking for what is on the horizon. It has been easy to bet big on the cloud, and it has been a big winner. But the future is the edge.

Best wishes,

Jon Markman