Humans got a rare win last week. That’s because Elon Musk admitted that his state-of-the-art Tesla (TSLA) factory might have too many robots.

The revelation came during a televised interview with “CBS This Morning” co-host Gayle King. It’s a big change of heart for Musk, who in the past has talked about completely automated factories.

Investors should use the news to buy robotics stocks.

According to Musk, the Tesla factory in Fremont, Calif., should be making 5,000 cars per week. In March, the plant could muster no more than a paltry 2,070 Model 3s.

Blame the Robots

Musk says the robots are ridiculously complex. They have been over-engineered. They are too fussy, and prone to weird failures. In March, the entire line had to shut down because one of the conveyors that moved parts in a choreographed sequence was off by a beat.

That is a far cry from Alien Dreadnought, the mythical fully automated factory floor Musk promised in 2016 …

Eventually, raw materials were to enter one end of the massive plant, and finished cars were to exit the other side.

It was supposed to be “Westworld” — the TV series where robots become more human, and humans become supporting actors, in a sense — for cars.

Unfortunately, it hasn’t yet put a stern metallic face on the future of manufacturing.

In fact, now Musk says humans are very much underrated. And he wants to hire more to get production levels where they need to be.

Related story: Tesla Revolution is in the Factory, Not the Car

On the other side of the world, the Chinese are moving in the opposite direction.

This China Shipping Terminal

Doesn’t Need Humans at All

On the same day Musk was admitting defeat, the Chinese government declared the world’s largest fully automated port shipping terminal was opening for business.

The Daily Mail reported the Yangshan Deep Water Port in Shanghai will be able to move 6.3 million, 20-foot shipping containers every year … without any humans.

The entire port will handle 40 million containers annually — the most in the world.

A staggering 26 bridge cranes, 130 autonomous vehicles, and 120 rail-mounted gantry cranes will move 136 million tons of goods … with very little input from humans.

It’s an engineering marvel — all software, metal and robotics might.

It’s also the shape of things to come, despite Musk’s frustration.

I have been telling my members to focus on the robotics leaders. Very often, these businesses operate outside the limelight, dominating specific niche markets.

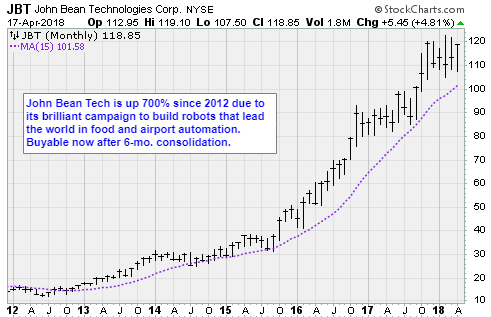

While Musk was dreaming about Dreadnaught, the managers at John Bean Technologies Corp. (JBT) were automating the food processing and packaging business.

They were working with clients to bring more sensors, artificially intelligent software and the Internet of Things to canning, vacuum sealing and film packaging.

The company also has a fast-growing aerospace ground support business, with impressive autonomous vehicles for loading and warehouses.

According to BI Intelligence, a market research firm, the number of installed Internet of Things devices to is expected to surge from 237 million in 2015 to 923 million by 2020. And global manufacturers are expected to spend $267 billion on new gear to make factories run smoothly.

JBT already works with Campbell Soup, Coca-Cola, Del Monte, Dole Foods, Florida Natural Growers, General Mills and others. It’s also rapidly building scale in Asia.

The company is the logical winner as food processing factories adopt smarter, connected systems to increase productivity.

The financials are beginning to reflect the potential. In 2017, sales advanced 21% to $1.63 billion. That came after growing 22% in 2016.

Meanwhile, the stock has been a model of consistency. The five-year average return is 43.9%. That means a modest investment of $10,000 over that time frame would be worth a cool $34,458 today.

Better still, shares have been consolidating for the past six months between $105 and $122.

JBT is set to release first-quarter financial results May 1. Unlike Elon Musk and Tesla, the corporate history at JBT is to underpromise, and overdeliver. Buy JBT stock into any weakness.

Best wishes,

Jon D. Markman

P.S. JBT is up 37.3% since I recommended it to my Tech Trend Trader members last year. All my research tells me it has plenty more upside from here. But that’s far from the biggest open gain we are sitting on right now. And there are many more ways to play the powerful wave in automation, artificial intelligence, the Internet of Things and more … with far-bigger profit potential. Click here to learn more.