MOST STOCKS SUCK!

Turn the tables on Wall Street’s sharks, scam artists, and snake-oil salesmen with a few high-quality stocks that make money year after year!

MOST STOCKS SUCK!

I’m sorry to put it so bluntly, but it’s true:

Most stocks are barely worth the paper they’re printed on.

That’s why you can be in the middle of a raging bull market with the Dow and S&P setting new records every day...

While the vast majority of stocks lag behind like turtles in a horse race.

For example:

Many of the market’s best days in recent months have been driven mostly by just SIX technology stocks...

Facebook, Apple, Alphabet, Netflix, Google, and Microsoft.

“A rising tide lifts all boats,” they say.

But when it comes to the stock market, most boats are stuck in the mud.

So if you own a mutual fund…

Or an exchange-traded fund…

Or a family of 401(k) funds managed by your employer…

Or even a “diversified” portfolio of individual stocks in different sectors…

Then, my friend, you own a big pile of dung that will never be worth much more than what you paid for it.

And it soon could be worth a lot less!

In fact, I estimate that of the roughly 3,700 publicly-traded companies on the stock exchange today …

Only about 42 are worth your time and attention.

Because even though the Dow and the S&P could go up over the next ten years …

You need to do better than the Dow to keep up with the inflation and global financial disruption that is sure to come in the years ahead.

In a moment, I’m going to tell you who those 42 companies are and why you’ve probably never heard of them.

I’ll tell you why buying shares in those companies today could earn you a return of at least 23.9% per year (and often A LOT more )

And just the 23.9% is enough to:

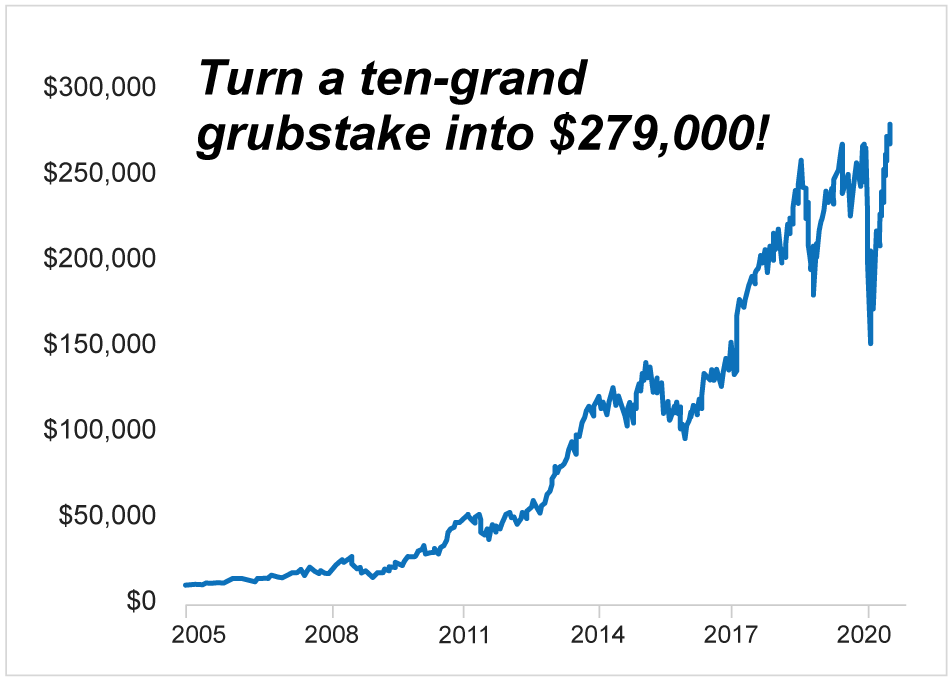

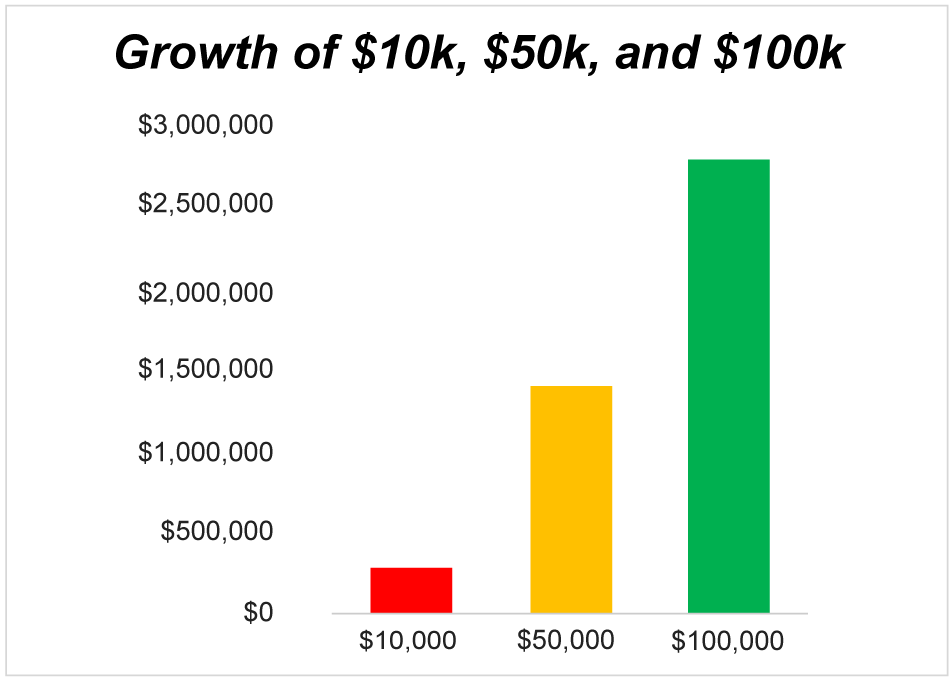

Turn a small grubstake of $10,000 into $279,123 …

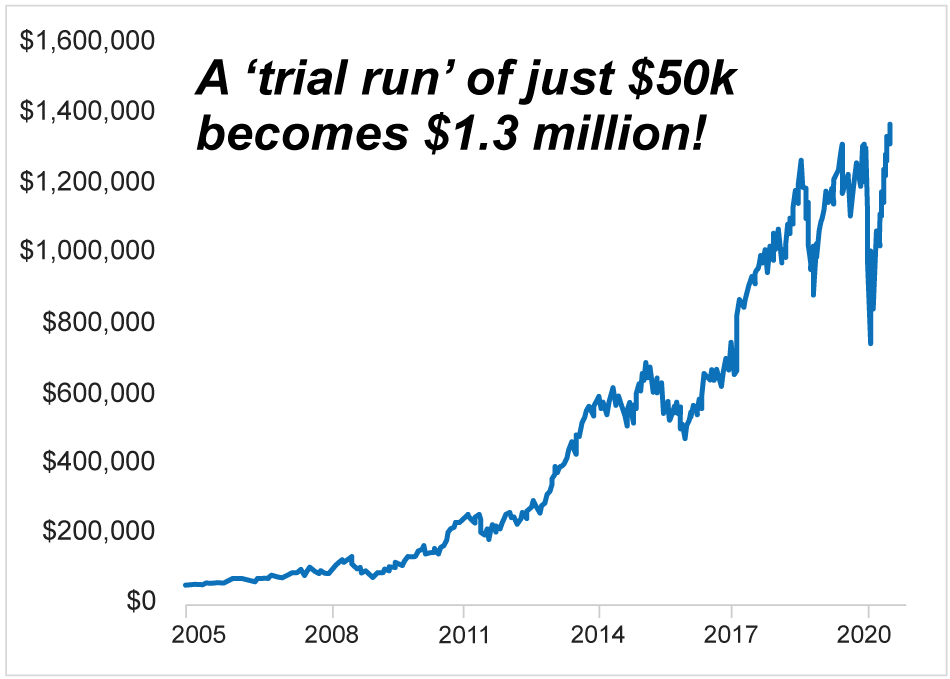

Take a “test run” of $50,000 and you could turn it into a life-changing $1,395,614.

Or you could turn a typical retirement nest egg of $100,000 into a whopping $2,791,228!

Over a relatively short period of time …

And with a relative safety and security you’ll never find in the broader market.

I’ll even give you the name of just ONE STOCK that sold for around $2.61 a share in 2008 …

If you invested $10,000 back then, you’d be sitting on $1,490,881 today.

If you invested $25,000, you’d be retired today with nearly $4 million in the bank.

And if you’d invested $100,000, it would be worth almost $15 million today — putting you in the top 1% of the richest people in America.

But there’s still plenty of room for more growth ahead.

Am I talking about some high-flying tech company like Facebook or Google?

No, I’m talking about a company that makes pizza!

I’ll tell you the name of that company in just a moment …

But before we go any further, let me tell you why I can talk to you so frankly about your investments.

It’s because I don’t work on Wall Street!

And I never wanted to.

When I graduated from Duke University and the elite Columbia University School of Journalism …

I wanted to become an investigative reporter.

And I did exactly that.

I landed a job at the Los Angeles Times.

Where I was part of a staff of editors who won two Pulitzer Prizes for reporting on the Rodney King riots and the Northridge Earthquake.

But then an “earthquake” took place in my own life …

It was a tectonic shift that changed the direction of my career:

My father died.

Not suddenly or unexpectedly.

But he left us before he had enough time to plan for it.

You see, my father was a successful entrepreneur. He owned several businesses. Lots of real estate in southern California. Even a private airplane.

But when he died, my mother was too overwhelmed to deal with it all.

So, I stepped in to help her out.

For the first time in my life, I had to learn something about the stock market.

What I found out really opened my eyes …

For example, I found out that my father had not one, but four stockbrokers.

And it didn’t take me long to find out that most of them were ripping him off.

No, they weren’t stealing his money.

But they were playing the perfectly legal “carny games” for slowly taking an investor for everything he’s worth.

It didn’t take me long to realize that my dad had been suckered—even though he was a very smart man, who was very good with money.

And very savvy about business!

I figured that if Wall Street could rip off my father, they could rip off anyone.

And the more I looked into it, the more I realized that is EXACTLY the case.

So, I fired all of my father’s brokers and decided to go it alone.

I bought or borrowed nearly every book I could find on how to invest in the stock market.

And I burned the midnight oil studying those books while still keeping my job on the news desk at the Times.

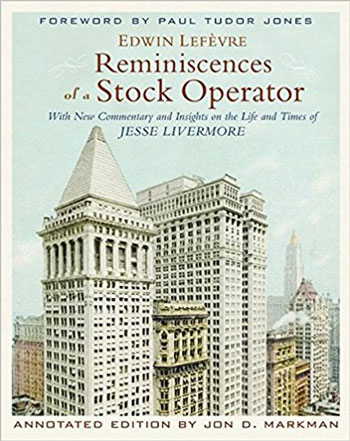

One book in particular had a major impact on me.

The book was called

“Reminiscences of a Stock Operator.”

It was the story of the greatest stock trader of all time: Jesse Livermore.

During the course of his career, Livermore made hundreds of millions of dollars in the stock market.

In 1906, he sold short after the San Francisco earthquake and made $250,000 — or about $6 million dollars today.

A year later, he made a million dollars in the Panic of 1907 — or roughly $24 million in today’s money.

Then in October of 1929, Livermore shorted the market before the crash and made nearly $100,000,000 in just seven days of trading.

That’s about $1.3 BILLION in today’s money!

But Livermore also LOST a lot of money during his career.

And he eventually came to the conclusion that the stock market was rigged against the average investor.

When Livermore sat down with journalist-novelist Edwin Lefèvre to write “Reminiscences of a Stock Operator” …

There was one message he wanted to convey above all others.

It was a message so simple it could be summed up in just four words:

“Don’t be a sucker!”

Livermore, in other words, wanted to give the average investor a way to fight back against the powerful forces arrayed against him.

He wanted to give people like you and me a fighting chance in the stock market …

Despite all the pitfalls, traps, and snares that have been deliberately set to take our money.

I didn’t realize it at the time, but reading “Reminiscences of a Stock Operator” would change my life.

Shortly after reading it, I decided to switch jobs.

I decided to move from the news desk of the Los Angeles Times to the Business Section.

And I did it for a simple reason:

I wanted to spend my day studying stocks!

Plus, I wanted to get my hands on the expensive research tools the Times had for tracking the financial markets.

The more I studied this research, the more I realized that Livermore was right:

Wall Street sucks up your cash like a vacuum cleaner, and the average investor is getting played for a sucker.

The vast majority of stocks on the exchange are nothing more than “sucker stocks.”

Their primary purpose?

To separate you from your money.

Chances are, YOU own some of these stocks.

You can’t avoid it!

Even if you own mutual funds, exchange-traded funds, or index funds.

In fact, the more “diversified” your portfolio is, the more sucker stocks you own.

(In a moment, I’m going to show you a list of stocks that nearly everyone owns … and nobody should!)

You bought those stocks because you wanted to build wealth for you and your family.

But what you’ve really done is make other people rich.

Here’s how Wall Street’s “carny game” works:

It’s simple, really.

Hedge funds and other insiders are very good at finding undervalued stocks.

So, they scoop them up at bargain basement prices.

Once they’ve got a corner on these stocks, they tip off the analysts.

The analysts write glowing reports on these stocks and rate them as a “strong buy.”

Then the business media — The Wall Street Journal, CNBC, and Fox Business — jump on the bandwagon and start touting these stocks to the retail investor.

When Cramer blows his horn, is he full of hot air?

A guy like Jim Cramer, for example, rings his bell, blows his horn, and says, “You’ve got to buy this stock!”

So, millions of small investors do exactly that.

And the price goes up.

But when the stock reaches its full valuation, the hedge funds and brokers get out.

And the small investor gets left holding the bag.

It’s “pump-and-dump” …

But it’s “perfectly legal.”

Here are five sneaky scams Wall Street insiders use to separate you from your money:

-

Does your broker encourage you to trade too often?

Trading every day, or even every week, is a typical sucker mistake.

Imagine a baseball player who liked to swing at every pitch. His career wouldn’t last very long, would it?

But many brokers urge their clients to buy and sell often because it means more money in commissions for them.

They call this “churning” your account, and some brokers are experts at it—constantly calling you with advice to buy or sell a stock right away.

So your portfolio slowly goes down while your broker’s profits go up and up.

-

Does your financial planner tell you to “buy and hold?”

This is the opposite mistake, but it’s just as bad.

Because you can buy-and-hold your way right into the poorhouse.

One of America’s oldest and most successful companies is now going out of business.

Think of all the high-flying stocks over the years that are worth next to nothing today.

For nearly 130 years, SEARS has been one of America’s iconic businesses

As recently as 2007, a share in the Sears Holding Company sold for $140.

But recently Sears announced they may be “unable to continue as a going concern.”

In other words, they’re going out of business.

Which means you might as well use your shares in Sears to line your birdcage.

Enron once traded for $90 a share, now it no longer exists.

TiVo once sold for $107, now you can pick up a share for $18.45.

Twitter used to sell at $73, now it’s worth fifteen bucks.

The graveyard of stocks that have fallen more than 80% include such famous names as Pitney-Bowes, Motorola, Cisco, and Texas Instruments.

Investors who buy and hold think they’re being conservative and cautious.

But, in fact, they are playing the most risky game of all.

-

Have you ever chased your losses or cut your gains?

If so, you’ve fallen victim to the two most deadly traps in the stock market — hope and fear.

You hold on to a falling stock because you hope it will turn around any day now.

Or you take your profits on a winning stock too soon because you fear it could start to fall.

But, in fact, you should do the exact opposite.

You should hope your rising stocks keep going up because that’s what rising stocks usually do.

And you should fear your falling stock will keep falling…

So get out NOW while the getting’s good!

-

Has your broker told you to buy at the bottom or sell at the top?

Trying to time the market with a stopwatch is a sucker mistake.

Many investors have gone broke trying to catch the first or last fraction of a point.

You should always wait for confirmation that a change in direction is well underway before you make your move.

Because being “right” about a stock too soon is just as bad as being wrong!

-

Has your advisor told you buy lots of stocks for “diversification?”

“Don’t put all your eggs in one basket,” your mother told you.

And your broker probably tells you the same thing.

The more stocks you own, he says, the safer you’ll be.

Because if one sector goes down, another sector will go up.

Makes sense, right?

And remember what I told you earlier:

Most stocks suck!

So the more stocks you own, the more likely your nest egg will go down.

If your portfolio is mostly in mutual funds and ETFs, you’re only making matters worse.

Because instead of owning just one sucker stock, you’ll own a big stack of them!

Andrew Carnegie said, “Put all good eggs in one basket as long as you WATCH the basket.”

One of the richest men in history, Andrew Carnegie, had some better advice for investors:

He said it’s okay to put all your eggs in one basket …

“As long as you WATCH the basket!”

So, what’s your alternative?

There is no alternative!

Cash, bonds, and gold simply won’t cut it in this economy.

The U.S. stock market is still the best place to put your money, keep it safe, and make it grow.

Especially now that the Federal Reserve is backing your investment with $4 trillion dollars of added liquidity.

The Fed, in other words, has taken all the risk out of investing in the stock market...

As long as you don’t shoot yourself in the foot by letting Wall Street play you for a sucker!

Yes, the stock market is still the place to be if you want to retire someday.

But not if you let yourself get played for a sucker.

You’ve got to figure out a way to turn the tables on Wall Street.

Fortunately, Jesse Livermore told us exactly how to do it:

He gave you 5 ways to turn

the tables on Wall Street

First, don’t feel you have to swing at every pitch.

There are no “called strikes” in investing.

So, you can wait for months — or even years — for the right pitch to come along.

And in many cases, you should!

Second, always trade along the “line of least resistance.”

Which means in a bull market you should run with the bulls …

But in a bear market you should run with the bears.

Third, cut your losses but let your winners run.

The trend is your friend.

If a stock goes up, buy more. If it goes down, sell.

Fourth, dip your toe in the water before you jump in.

Wait for the trend to reveal itself before you take a position.

Trying to be the first to buy or sell is a sucker move.

Fifth, keep your portfolio small and easy to manage.

Mark Cuban, the billionaire investor and co-host of Shark Tank, once said:

“Diversification is for idiots.”

“Diversification is for idiots.” - Mark Cuban

What do billionaires, like Mark Cuban, know that most investors don’t?

Building wealth is all about concentration … diligence … and focus.

It’s also about overcoming your own human nature.

Because human nature is your worst enemy when it comes to making money in the stock market.

And your best ally is the human nature of the people you’re trading against!

That’s why people still read and study “Reminiscences of a Stock Operator.”

People still read it today because Jesse Livermore didn’t always follow his own rules.

As a result, he often lost millions of dollars.

But he never made excuses.

He never wrote his losses off to “bad luck.”

He always analyzed the underlying cause of his mistakes.

And he came to a startling conclusion:

Every time he lost money it was because he let himself be swayed by his own emotions.

In other words, he fell victim to the same “sucker moves” that most investors do.

Of course, trading without emotion was nearly impossible in 1923.

But not anymore.

Because today we have something Jesse Livermore did not have.

We have a tool that can buy and sell stocks with no human emotion whatsoever:

Computers!

Computers help take human emotion out of buying and selling stocks.

In his book, Jesse Livermore said that a good trader only has four things going for him:

One: Observation.

Two: Experience.

Three: Memory.

Four: Mathematics.

Computers can do a better job at each of these things than any human being.

As long as you give them the right instructions.

Can “artificial intelligence” be used to buy and sell stocks?

That’s what an “algorithm” is, by the way:

Just a set of instructions you give to a computer.

If the instructions are good …

The computer can follow them faster … more accurately … and more efficiently than any human being ever could.

So that’s what I was thinking when I decided to leave the Los Angeles Times and take a job with Microsoft.

Working with the software developers at Microsoft, we did something that had never been done before:

We developed a stock-screening and stock-selection system that was entirely run by computers.

In short, we were applying artificial intelligence to the process of stock selection.

We called it the StockScouter screening system.

At MSN Money, I helped create the first online system for screening stocks.

That system became the heart and soul of MSN Money, where I was the first managing editor.

But even back then, I had an inkling that screening stocks was just the start of what computers could do.

So, after a few years, I left Microsoft and struck out on my own.

My goal was to create a computer model that could buy and sell stocks all by itself.

I believed that by using artificial intelligence, we could “reverse engineer” Jesse Livermore …

We could duplicate the genius of history’s greatest trader to make money in today’s stock market.

But I knew that if I was going to achieve this goal, my computer model would have to do three things:

First, the model would need to

trade without emotion.

We would have let it follow the algorithms we set for it without allowing our own emotions to get in the way.

We couldn’t second-guess the algorithm or overrule it if we felt it was wrong.

We had to let it make its own decisions … its own judgments … and, yes, even its own mistakes.

As long as it could learn from them.

Second, the model would need to know

when to buy and when to sell.

We would have to tell the computer how to use Jesse Livermore’s “Pivotal Point.”

Which was his trick for knowing when a stock was about to change direction.

And how to confirm that change of direction so it wouldn’t be fooled by minor pullbacks and corrections.

Third, the model would need to

find the right stocks to buy.

To do this, we simply told the computer to sift through all the large-cap stocks on the market …

And come back with the ones that met a certain set of criteria.

Like a bloodhound, we told the computer what kind of stocks to look for. Then we told it to go out and find ‘em!

It was like letting a bloodhound sniff a scrap of a prisoner’s clothing …

Then telling it to go out and bring him back.

Specifically, we built the algorithm to look for companies that could answer “yes” to these 10 questions:

- Is the company currently making money?

- Has it made a profit in at least 7 of the last 8 years?

- Does it have plenty of cash on hand?

- Does it have the right level of debt for its size?

- It its industry growing?

- Have the shareholders gotten a good return on their money?

- Has the company created any new products or services recently that might increase the value of its stock?

- Has it recently revised its earnings estimates upward?

- Are some investors selling the stock for reasons that have nothing to do with the inherent quality of the company? And …

- Is the stock’s price rising … but still reasonably priced?

So, we turned the computer loose to let it look for companies that met those criteria.

What it came back with shocked us …

There were very few high-flying tech stocks like Amazon, Google, or Facebook.

Not many famous blue chips like American Express, Johnson & Johnson, or McDonald’s.

No darlings of the moment like Zoom, Slack or Tesla.

What the computer found instead were …

The strangest stocks you’ll ever fall in love with!

And when I say strange, I really mean BORING!

These are stocks your broker will NEVER recommend to you.

You’ll NEVER hear anyone whisper about these stocks at cocktail parties.

Jim Cramer will NEVER ring his bell or blow his horn about one of these stocks on TV.

For example:

There’s a company that helps people get rid of cockroaches and ants.

There’s a company that makes mobile homes and recreational vehicles.

There’s a company that will clean your swimming pool for you.

And one that makes snack foods.

Sound exciting?

Not at all.

Not until you look at how much money these companies make.

How much income they throw off in dividends.

And how their stock prices go up year after year, in good markets and bad.

Then you’ll find them very exciting indeed.

So exciting that I call them …

The Power Elite!

What do The Power Elite stocks have in common?

They’re in industries that may not be glamorous …

But they’re steady and reliable moneymakers.

They are often in niche markets, and they’ve gotten very good at their niche.

Their products tend to be: a) necessary; b) addictive; or c) the best in their industry.

So, they can charge higher prices than the competition.

They are mid- to large-cap corporations …

But they run their business as if they were small, private companies:

Nimble. Thrifty. Accountable.

They have great cash flow and minimal debt.

They keep tight control on their costs.

One of the ways they do that is with cutting-edge technology.

No, they are not all technology companies.

But they’re good at using technology to keep overhead low and customer satisfaction high.

Just as important as the things they do well, however, are the things they don’t do:

They never make stupid acquisitions or mergers…

They don’t expand into markets they don’t understand…

They don’t pay their executives outrageous salaries.

Bottom line?

These are stocks that knock it out of the park year after year.

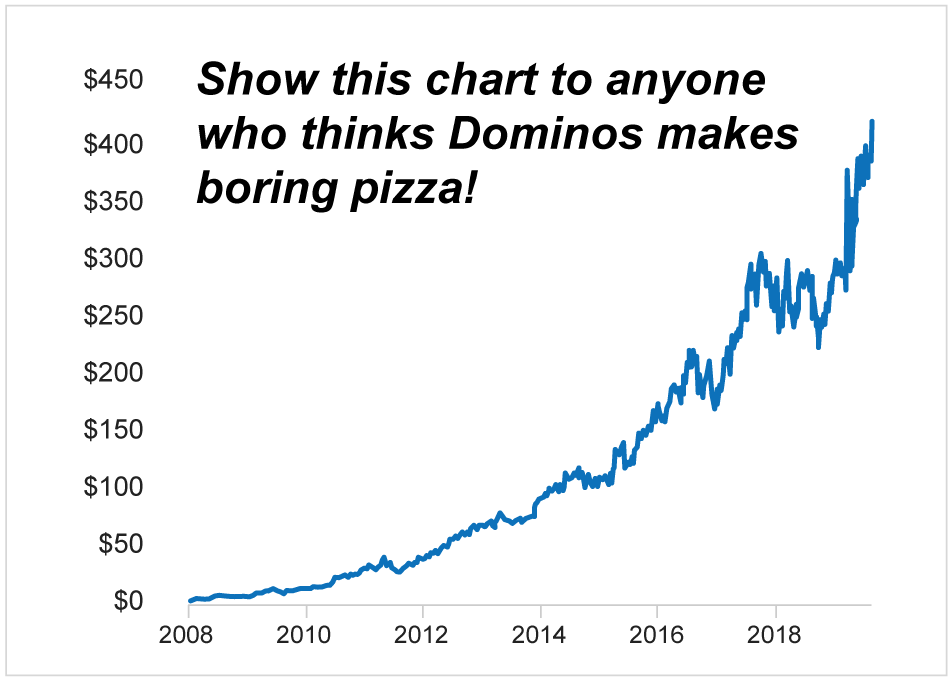

Let’s take a look at Domino’s Pizza, for example. (Ticker symbol: DPZ)

You may think their pizza is boring, but you can’t deny it’s a beautiful stock.

In 2008, a share of DPZ was selling for around $2.61 …

Today it’s worth $389!

Which means that if you took a flyer on DPZ with $10,000 back then, you’d be sitting on $1,490,000 today.

If you bought $25,000 worth, you’d be retired with $3.5 million in the bank.

And if you invested $100,000, you’d be worth nearly $15 million today — which would put you in the top one percent of the richest people in America.

You might expect that kind of growth if you got in on the ground floor of Amazon, Facebook, or Google.

But a pizza stock?

Here’s Domino’s’ secret:

Domino’s is both a fast-food stock and a technology stock.

Because they have mastered the technology of ordering, baking, and delivering a pizza.

If you’re Domino’s customer, you barely have to think about pizza before the delivery guy knocks on your door.

Because they have automated the process of taking orders by smartphone or on the internet …

Making the pizza quickly according to your personal preferences …

And delivering it efficiently to wherever you may be.

In other words, they’ve taken all the hassle out of ordering a pizza.

In the same way Uber has taken all the hassle out of taking a taxi.

At $389 a share, you might think DPZ has reached its full valuation.

Don’t be too sure!

Dominos is still only a $15 billion company.

Starbucks is a $113 billion company.

And McDonalds is a $160 billion company.

Which tells me Dominos still has plenty of room to grow.

So, don’t sell Domino’s short — even if you don’t like their pizza.

Stocks like Domino’s are rare.

But they’re out there if you know where to look.

And our POWER ELITE model is very good at finding them.

Some of them make products that people and businesses simply need to have.

If you want to make a computer chip nowadays — and who doesn’t? — you simply must use Cadence Design Systems. [TICKER: CDNS]

Cadence is not a chip designer, but it makes the software that chip designers use to do their job.

With only one other company in the field, it’s either a monopoly or a “duopoly.”

No wonder Cadence is up more than 3,500% in the last twelve years!

Now, what I’m about to say may not be pleasant to hear...

Some Power Elite companies make products that are addictive.

Which is why you find so many fast-food and “fun-food” companies among The Power Elite.

Take J&J Snack Foods [TICKER: JJSF], for example...

Which makes everything from pretzels to funnel cake to fruit pies.

Americans may be trying to cut down on fat, sugar, and salt...

But don’t bet on it happening anytime soon!

Here’s another group that often takes a seat among The Power Elite…

Military contractors.

But not just the ones you know like Lockheed or Northrup Grumman.

Our computer model found a company called Transdygm [TICKER: TDG], which provides many of the parts and electronics needed to make an airplane.

So whether the Pentagon decides to build more airplanes in the years ahead...

Or just repair the old ones...

Transdygm will be making money hand over fist.

And when the commercial airline business recovers after the pandemic...

Transdygm will make even more money.

Because the world is in desperate need of new airplanes.

Businesses like these will not merely survive the coronavirus crisis...

They will thrive in its aftermath.

They won’t just withstand the pandemic, in other words...

They will prosper!

Take Crown Castle International, for example. (TICKER: CCI)

Talk about a “boring” business!

All they do is own a bunch of big antennas around the country.

But cellphone giants like AT&T, Verizon, and T-Mobile pay big money in rent to put their microwave dishes on those antennas.

And with 5G is spreading like wildfire across America...

Crown Castle will not only be charging them more in rent ...

They’ll be building more antennas, too.

They already own the best locations for cellphone signals in the country.

And with only two other major companies in the business, they have a virtual lock on the market.

In short?

CCI is a money-making machine!

That’s why it’s up more than 65% since we added it to The Power Elite portfolio.

But you’ve probably never heard of it before.

You’ve probably never heard of Pool Corporation either. (TICKER: POOL)

They’re in the swimming pool supply business.

Invest in a swimming pool company?

In this economy?

Laughable, right?

But you’ll be laughing all the way to the bank.

POOL is up more than 75% since we added it to the portfolio.

Why?

Because POOL makes money like clockwork, year after year.

Once a pool gets installed, the owner always needs supplies and chemicals.

And Pool Corp. has the market cornered in most the of the Sun Belt.

Which is the most lucrative part of the United States for swimming pool companies.

So Pool Corp. isn’t just surviving the current economy ...

It’s thriving!

Because the mom-and-pop companies in the pool business simply can’t compete with them...

And some are going out of business.

You see, I developed The Power Elite portfolio to help investors put together consistently big gains.

How?

By focusing on niche companies with dominant market positions...

Strong cash flows.

And overwhelming competitive advantages.

Just like CCI and POOL.

But let me give you an important warning:

Don’t buy any of these stocks now!

Because while some of them remain in The Power Elite portfolio today...

Several others may soon reach a point where it will be time to take our profits...

And wait for a pullback before we buy them again.

In other words, they haven’t yet reached their “Pivotal Point.”

Which was Jesse Livermore’s uncanny way of knowing when a stock — or the market as a whole — was about to change direction.

My software developers and I have programmed the “Pivotal Point” into our computer model.

So we always know when to buy and when to sell.

But we never jump the gun.

We always wait for validation to make sure we’re not selling on a minor correction or buying on a dead-cat bounce.

Because being right about a stock too early is just as bad as being wrong!

Here are the 50 stocks that don’t suck!

Out of the roughly 3,700 publicly-traded companies on the U.S. stock market, for example …

Fewer than 50 stocks are currently in our POWER ELITE portfolio.

Which is good news for you …

Because it’s better to own a portfolio of thoroughbreds than a “diversified” portfolio of 3,700 nags on their way to the glue factory.

In a moment, I’ll tell you how to find out who those companies are — absolutely free — so you can buy as many shares as you want.

But first let me give you some idea of how much money you could make by investing in The Power Elite.

Because when you put The Power Elite stocks into one simple, easy-to-manage portfolio …

The results you get are nothing short of amazing.

Just take a look:

Our data tracking The Power Elite which spans back to January of the year 2005, shows that the portfolio would have enjoyed a total compounded return of 2,691.23%.

That’s enough to turn a small stake of just $10,000 into $279,123.

Enough to turn a modest portfolio of $50,000 into $1,395,614.

Or turn a typical 55-year-old’s retirement nest egg of $100,000 into a whopping $2,791,228.

That’s the S&P 500, the benchmark of the nation’s largest 500 companies

Now take a look at the blue that’s shooting up like a skyrocket to the moon.

That’s based on the data from The Power Elite portfolio.

Why does it work so well?

Because more than 71% of the trades — or nearly three out of four — would have been winners.

Which means that if you’d invested in the same stocks The Power Elite portfolio in 2005? …

You could’ve earned an impressive 23.9% annual return on your money.

And with far less risk than nearly every other high performing portfolio in the world.

(Relative risk is measured with a number called Sharpe Ratio, which in this case was just 1.09.)

Over the past 15 years, in fact, there’ve been only three years when The Power Elite underperformed the S&P 500.

So, who are these boring-but-beautiful companies?

Exactly who are The Power Elite?

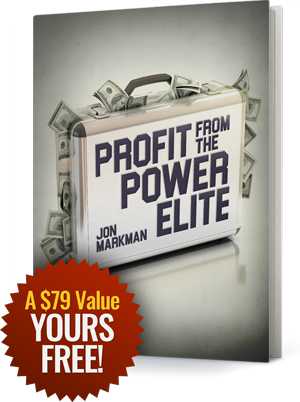

YOURS FREE:

“PROFIT FROM THE POWER ELITE!”

I’m going to reveal their names and ticker symbols to you in a brand new e-book called: “Profit from The Power Elite.”

In this short-but-powerful guide I’ll lay out FOUR EASY STEPS you can take today to help streamline your portfolio …

Drastically reduce your risk …

And start getting the kind of growth you need and deserve.

I’m talking about the kind of growth that can put you on the path to an early retirement — even if you’re off to a late start.

And if you’re already retired …

I’m talking about the kind of growth that will help you

Stop worrying about outliving your money.

Stop worrying about medical bills … rising property taxes … and unforeseen expenses.

And START thinking again about the home on the 18th fairway …

The cabin cruiser …

The once-in-a-lifetime trip you always wanted but didn’t think you could afford.

There are really just FOUR EASY STEPS you need to take.

And each of them is spelled out chapter-by-chapter in your free copy of “Profit from the Power Elite.”

Clicking does not obligate you to buy anything!

STEP #1 is to get rid of your

“sucker stocks” now!

In Chapter One, I’m going to start by giving you a “blacklist” of the stocks that nearly everyone owns …

Some stocks eat holes in your portfolio like moths in a sweater. Get rid of them now!

And nobody should!

I guarantee you have at least one and probably dozens of these stinkers in your portfolio.

If you don’t own the individual stocks, you own them in a mutual fund, index fund, or ETF.

And they’re bleeding you dry!

Don’t be fooled by famous names … good publicity … or even recent performance:

Goldman Sachs … Alcoa … Caterpillar … Halliburton … Citigroup … Hess … Chico’s …

Freport McMoRan … Hewlett-Packard … Newmont Mining …

The list goes on and on.

More than 50 in all.

Stocks like these are eating holes in your portfolio like moths in your sweater drawer, and you’ve got to get rid of them NOW!

STEP #2 is to stop letting Wall Street trick

you into making “sucker” mistakes …

Believe me, we all make “sucker mistakes.”

I’ve done it.

Don’t let Wall Street play its “carny tricks” on you!

My father, who was the smartest man I ever knew, did it.

But it’s not our fault.

Like the carnival barkers at the county fair, the wise guys on Wall Street have come up with tricks and traps designed to use our own human nature against us.

And in Chapter Two of “Profit from the Power Elite,” I spell them out in detail so you’ll never fall for them again. I’m talking about mistakes like these:

- Betting on long shots

- Dollar-cost-averaging

- Buying a stock on “good news”

- Believing anything a company says about its own stock

- Being a “Perma-bear” or a “Perma-bull”

- Taking your profits too soon

- Buying “me-too” stocks because the industry leader is too expensive

- Acting on “hot tips”

- Selling on new highs

But I’m just scratching the surface.

I’ll explain these and many other common mistakes in Chapter Two of your free book.

Then, once you’ve sold your sucker stocks and vaccinated yourself against making sucker mistakes …

I’ll reveal the only 50 stocks you need to buy — The Power Elite!

Clicking does not obligate you to buy anything!

STEP #3 is to check out the stocks in

“THE POWER ELITE!”

Fewer than 50 stocks!

That’s all there is to it!

But you don’t have to buy all of them if you don’t want to.

Start with five, ten, fifteen … however many you’re comfortable owning.

Chances are, you won’t recognize the names of some of these stocks.

Because, as I said before, these companies are not hyped by the Wall Street pump-and-dump machine.

We might recommend a company that sells pretzels and cookies.

Or one that makes the lubricating oil that comes out of a spray can.

Heck, one of our top-performing companies owns trailer parks!

Trailer parks?

Don’t laugh!

It’s a growing industry that makes money month after month, year after year.

With the baby boomers getting older...

And with many of them worried they won’t be able to make their money last...

You’re better off investing in trailer parks than skyscrapers!

Much better off.

No wonder this stock is up more than 32% since we added it to The Power Elite portfolio.

But what companies like this may lack in sex-appeal...

…they more than make up for in steady, reliable, sometimes spectacular growth.

Should you hold onto them for the rest of your life?

No!

As I said before, buy-and-hold is a sucker’s game.

That’s why you need to know exactly when to buy and when to sell.

Which brings me to the fourth and final chapter of your free book …

Clicking does not obligate you to buy anything!

STEP #4: Find out how to use

the “PIVOTAL POINT!”

Jesse Livermore’s greatest breakthrough was his discovery of what he called the “Pivotal Point.”

It’s the turning point when a stock changes direction.

It’s the point when a falling stock suddenly stops, catches its breath, and begins to climb again.

In Chapter 4 of your free book, I’ll tell you how YOU can use the Pivotal Point in your own trading.

Is it complicated?

Well, it’s not easy.

To find the Pivotal Point you need to be able to track price movements …

Analyze the subtle patterns on stock charts …

And make several complex calculations.

But I’ve got some good news:

I’ve taken all the work out of it for you!

My software developers and I have created a computer algorithm that puts the Pivotal Point on autopilot.

That’s why when you click the button below to get your free copy of “Profit from the Power Elite” …

Clicking does not obligate you to buy anything!

I’ll also invite you to accept a risk-free subscription to my monthly bulletin.

You’ll get a ‘Flash Alert’ whenever you need to buy or sell!

“Three times a week, I’ll keep you posted on the risks and rewards of investing in the New Gilded Age.”

Your free e-book and monthly bulletin go hand-in-hand.

Because no matter how good a stock is, you’ve got to be patient enough to buy on the pullbacks …

And vigilant enough to sell when a stock reaches its full value.

But with your free e-book and monthly bulletin, you’ll spend no more than 10 minutes a week managing your portfolio.

And I’ll make it even easier for you by sending you “Flash Alerts” by email whenever there’s a change in prices that calls for you to make a move.

Plus, I’ll give you a free lifetime subscription to my e-zine, Jon Markman’s Pivotal Point.

Each issue of The Power Elite, by the way, contains a “model portfolio” that shows you exactly what to buy, what to hold, what to sell … and when.

Clicking does not obligate you to buy anything!

What kind of growth can you

expect in the years ahead?

Of course, past performance is no guarantee of future results, and losses can and will happen …

But our back-tested Power Elite portfolio has shown an average return of 23.9% over the past 15 years.

Which means you could be looking at turning a small “test run” of $10,000 into $279,123 …

Or you could watch a modest $50,000 portion of your portfolio turn into $1,395,614.

And if you can put $100,000 into The Power Elite portfolio …

You could see it grow to well over two million dollars by the time you retire:

$2,791,228 to be exact!

Given results like that, how much would you be willing to pay to join The Power Elite?

A thousand dollars a year?

Five hundred?

What if I told you that membership in The Power Elite costs only $228 a year.

And since this is the first time we’ve opened The Power Elite to the public …

Turn your pocket change into massive profits!

My publisher is prepared to take nearly two hundred dollars off the price if you join within the next 10 minutes.

So, you’ll pay just $29 for one year of membership in The Power Elite …

That comes to about 7 cents a day.

Think about that!

You’ll pay a nickel and two pennies for advice and guidance that could help you retire a millionaire.

Why am I charging so little?

Clicking does not obligate you to buy anything!

Because I’m on a mission …

I’m on a mission to take on Wall Street’s “carnival barkers” and expose their con games once and for all.

I want to prove that you DON’T have to have to buy a big basket of sucker stocks for the sake of diversification …

That you DON’T have to trade every day — or worse yet, buy and hold forever — in order to make money in the market.

In other words, I’m on a mission to help you TURN THE TABLES on Wall Street and beat them at their own game.

That’s why I’d like to send you 3 MORE FREE REPORTS to help you make money — and stay safe — in what I expect to be a difficult year ahead:

Clicking does not obligate you to buy anything!

FREE RESEARCH REPORT #1:

“The Beauties (And the Beasts) of Utilities!”

Are you worried about the bonds in your portfolio?

You should be!

Because today’s bonds are not only failing to produce a decent level of income …

But thanks to the global debt crisis, many of them have become riskier than stocks!

Fortunately, you have a great alternative to bonds when it comes to investing for income:

Utilities!

Because utilities have become both income and growth stocks.

With more and more electronic devices in the home and electric cars in the driveway …

The demand for electric power is growing like crazy.

So, the price of utility stocks keeps going up and up.

But electric power is still a regulated industry.

So, the income flow remains safe and reliable.

Especially in areas where the population is growing and incomes are rising.

Which is why stocks like ATMOS Energy … American Electric Power … and Chesapeake Utilities are solid investments for both growth and income.

But not every utility is a good buy.

Some of them are real stinkers.

So please send for your free report where I’ll tell you exactly who’s the beauty — and who’s the beast — when it comes to utilities.

Clicking does not obligate you to buy anything!

FREE RESEARCH REPORT #2:

“The Disruptive Dozen”

There’s never been a better time in history to be an investor.

Yes, I realize the recent volatility in the stock market can make you dizzy at times.

It might even make you want to sell all your stocks and hide your money under the mattress.

But don’t do it.

Because you and I are about to witness an explosion of wealth unlike anything this country has seen since “The Gilded Age.”

Imagine getting into the oil business with John D. Rockefeller.

Or starting a railroad with Cornelius Vanderbilt.

Or partnering with Andrew Carnegie on a steel mill.

These are the kind of opportunities you and I have in what I call “The Age of Digital Disruption.”

I’m talking about massive opportunities like those in 5G wireless, which is set to trigger a $12 trillion avalanche of cash as it revolutionizes self-driving cars, tele-surgery, artificial intelligence, virtual reality, and more.

Big money is quietly flowing into these companies right now.

And yet on Wall Street many of these stocks are still flying under the radar.

That’s why I’ve put together a list of 12 stocks that have the potential to create life-changing wealth for you …

And generational wealth for your children and grandchildren.

If you had bought just $10,000 worth of ATVI stock on the day it began trading on the NASDAQ small-cap exchange and reinvested the dividends

Take Activision Blizzard [Ticker: ATVI], for example, a developer of video games like “Call of Duty” and “Madden NFL.”

If you had bought just $10,000 worth of ATVI stock on the day it began trading on the NASDAQ small-cap exchange and reinvested the dividends …

It would be worth $753,600 today.

An investment of $100 grand would be worth over $7.5 million.

Imagine turning $10,000 into $753,600!

But it still has plenty of room to grow in the months and years ahead. The sky is the limit for the video gaming industry.

Which is why I want to send you a copy of “The Disruptive Dozen” — absolutely free — today.

Clicking does not obligate you to buy anything!

FREE RESEARCH REPORT #3:

“Work-at-Home Winners!”

When the government asked Americans to shelter in place during the coronavirus pandemic …

Millions of white-collar employees began to work from home for the first time.

At first, it was stressful for both employees and management alike.

But as the weeks and months passed, working from home became the “new normal” for American business.

For many companies, the question was no longer when we bring the employees back to work … but if we need to bring them back at all.

Why pay all that money in rent, electricity, water, heating, air conditioning, sewage, and taxes if you don’t have to?

Going forward, it’s clear that many Americans will continue to work from home indefinitely.

Maybe forever.

We’ve already seen the effect this change has had on the soaring share prices of such obvious winners as Zoom, Slack, and Dropbox.

But the prices of those stocks are already too high.

If you don’t own them by now, in other words, you’ve arrived at the party after all the chips and beer are gone.

There are several work-from-home stocks, however, that are still flying under the radar.

There’s a company that facilitates video visits with your doctor.

A global consulting firm that helps businesses overcome the obstacles of working from home.

An IT management firm that provides technical support for small to mid-size companies around the world.

Even a shoemaking company poised to benefit from the fact that you can’t see what someone is wearing under their desk on Zoom!

I’ve put together a private research report on dozens of such companies that are ready for takeoff as more and more Americans work from home.

And it’s YOURS FREE when you give The Power Elitea try.

Take all the time you need after you click.

No obligation to buy.

I say “give it a try” because you risk no money to get your three free reports and subscribe to The Power Elite.

If you’re not fully satisfied with it for any reason — or for no reason at all — send me an email and I’ll gladly give you your money back.

No, I’m not talking about one of those “pro-rated” refunds on un-mailed issues.

That’s a carny trick!

I’m saying that even if you decide to cancel just one minute before midnight on the last day of your membership …

You’ll get back every penny you paid!

You can KEEP your free copy of “Profit from The Power Elite” …

KEEP your free copy of “The Beauties (And the Beasts) of Utilities” …

KEEP your free copy of “The Disruptive Dozen” …

And KEEP your free copy of “Work-at-Home Winners!”

That’s $316 worth of free reports that are YOURS TO KEEP just for giving The Power Elite a risk-free try.

Clicking now locks in your discount,

but does NOT obligate you to buy!

What if you send for your free books, get the names of those thirty-five Power Elite stocks, then ask for a refund right away?

Hey, that’s fine with me too!

Because I’m betting you’ll want to stick around for a while.

Here’s why:

By joining The Power Elite, you’ll be able to take advantage of the changes we make in the portfolio over the course of the next year.

You’ll know exactly when to buy and when to sell.

So, the time has come for you to make a decision …

You can put your savings in the hands of the sharks, scam artists, and snake-oil salesmen on Wall Street who’d like nothing more than to take it from you …

Or you can take control of it yourself.

You can invest in just a handful of “boring-but-beautiful” stocks that will give you a level of safety, reliability, and spectacular growth that you can only get from …

The Power Elite!

I trust that, in the short time we’ve spent together today, I have helped you become a better investor. And I hope to see you again soon.

Thank you so much for your time.

Sincerely,

Jon D. Markman, Editor

The Power Elite

Lock in your discount by clicking now