Get Rich in the Great Recession of 2019!

These “Elite Eight” Stocks Will Not Only SURVIVE the Next Correction, They’ll THRIVE in the Coming Recession!

Dear Fellow Investor,

It’s not a matter of IF, it’s a matter of WHEN.

After ten years of economic expansion and rising stock prices, a correction—or even a full-blown recession—is right around the corner.

According to billionaire hedge-fund manager Ray Dalio, “We’re in the seventh inning of a nine inning game.”

I disagree. I think we’re in the bottom of the ninth with two outs and two strikes!

But that doesn’t mean you’ll have to spend the next ten years watching your nest egg dwindle by twenty ... thirty ... or even fifty percent.

History has shown that some of the world’s greatest companies ... most valuable stocks ... and richest families got their start in economic downturns.

The Road to Riches Begins with Recessions!

Did you know, for example, that both GE and IBM were founded shortly after the Panic of 1878?

Microsoft and Apple opened their doors during the crushing “stagflation” of the Carter Administration.

General Motors, Disney, and Marriott are just a few of the Fortune 500 companies that began in the Great Depression.

So, yes, another deep recession could be on its way in 2019.

But now is NOT the time to get scared...

It’s time to get SMART!

Individual investors like you and me can no longer count on a rising tide lifting all boats.

Which means that “diversification” strategies like index funds, exchange-traded funds, and mutual funds are the road to ruin.

But investing in the right stocks at the right time is the road to riches.

Now is NOT the time to get out the market, in other words. It’s time to get into the stocks that will survive—and even thrive—in the coming recession.

Unfortunately, you and I have a problem. And it’s this:

Most stocks suck!

Most stocks are barely worth the paper they’re printed on.

I’m sorry to put it so bluntly, but it’s true:

Most stocks are barely worth the paper they’re printed on.

Which means that if you own a mutual fund …

Or an exchange-traded fund …

Or a family of 401(k) funds managed by your employer …

Or even a “diversified” portfolio of individual stocks in different sectors …

Then you, my friend, own a big pile of dung that will never be worth much more than what you paid for it.

And it soon could be worth a lot less!

I estimate that of the 4,500 publicly traded companies on the stock exchange today …

Only about 70 are worth your time, attention, and money.

Of those seventy, only eight are now selling at a price that would make them attractive to buy.

In a minute, I’m going to tell you who those eight companies are and why you’ve probably never heard of them.

I’ll tell you why buying shares in those companies today could earn you a 15.6% annual return.

Which is enough to:

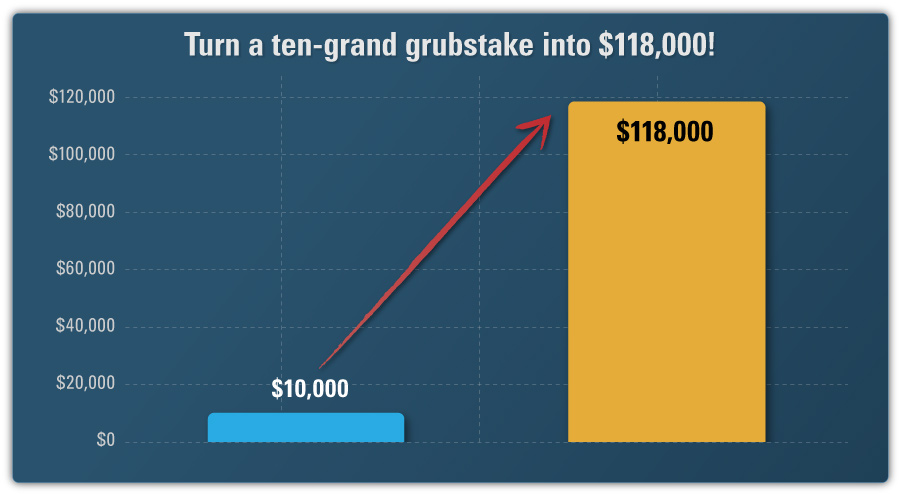

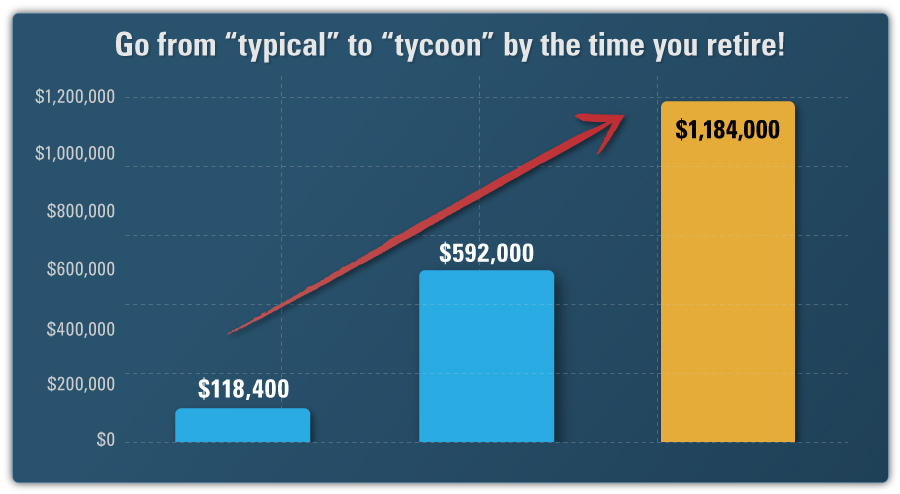

Turn a small grubstake of $10,000 into $118,400

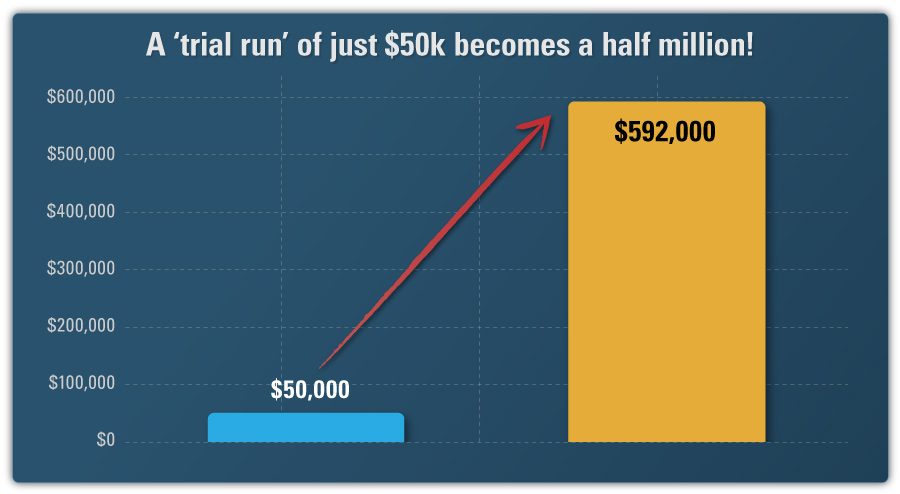

Take a “test run” of $50,000 and you could turn it into a life-changing $592,000

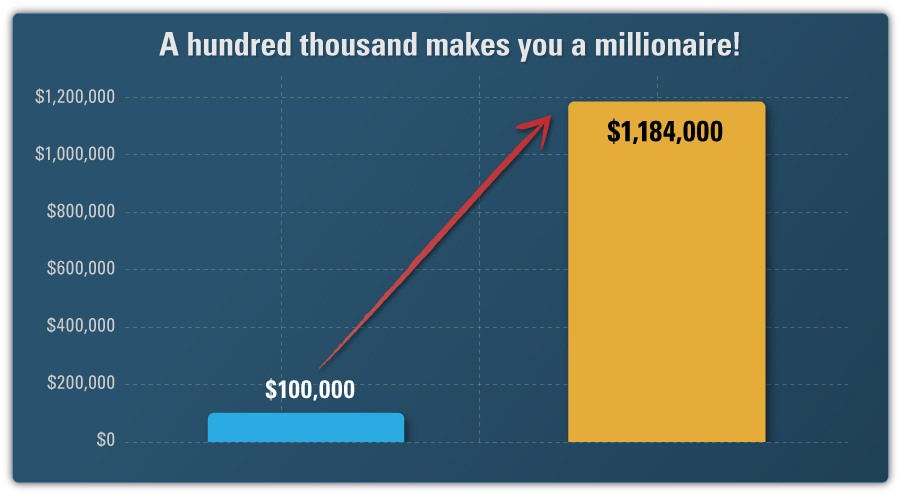

Or you could turn a typical retirement nest egg of $100,000 into a whopping $1,184,000!

Over a relatively short period of time …

And with a level of safety and security you’ll never find in the broader market.

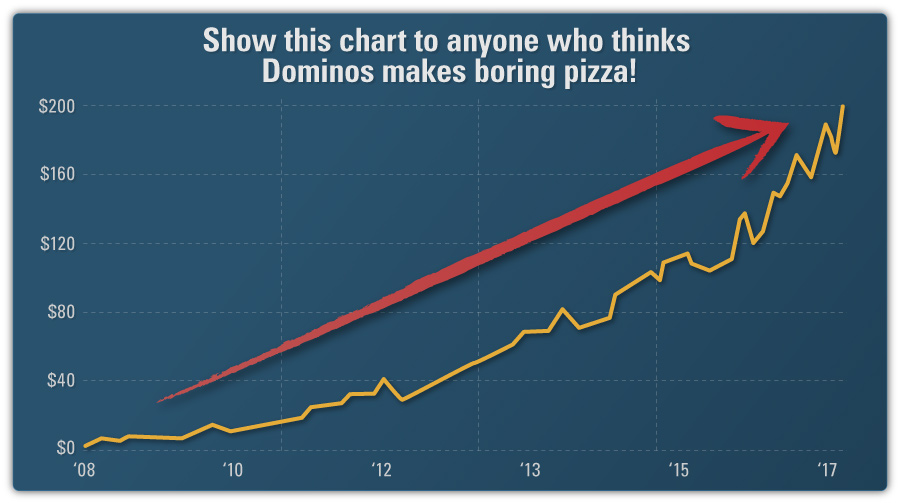

I’ll even give you the name of just ONE STOCK that sold for $2.50 a share just nine years ago …

If you bought $10,000 back then, you’d be sitting on $770,000 today.

If you invested $25,000, you’d be retired today with nearly two million in the bank.

Here’s what happens when technology and pizza come together.

And if you’d invested $100,000, you’d be worth $7 million today — putting you in the top 1% of the richest people in America.

But there’s still plenty of room for more growth ahead.

Am I talking about some high-flying tech company like Facebook or Google?

No, I’m talking about a company that makes pizza!

I’ll tell you the name of that company in just a moment …

But first let me introduce myself …

My name is Jon D. Markman.

And the reason I can talk to you so frankly about your investments …

Is because I don’t work on Wall Street.

And I never wanted to.

I was part of a team that won two Pulitzer Prizes for reporting.

When I graduated from Duke University and the elite Columbia University School of Journalism …

I wanted to become an investigative reporter.

And I did exactly that.

I landed a job at the Los Angeles Times.

Where I was part of a staff of editors who won two Pulitzer Prizes for reporting on the Rodney King riots and the Northridge Earthquake.

But then an “earthquake” took

place in my own life …

It was a tectonic shift that changed the direction of my career:

My father died.

Not suddenly or unexpectedly.

But he left us before he had enough time to plan for it.

And he left my mother a good deal of money.

Dad left my mom a lot of money. But she didn’t know how to handle it.

You see, my father was a successful entrepreneur.

He owned several businesses.

Lots of real estate in southern California.

Even a private airplane.

When he died, my mother was too overwhelmed to deal with it all.

So, I stepped in to help her out.

For the first time in my life, I had to learn something about the stock market.

What I found out really

opened my eyes …

For example …

I found out that my father had not one, but four stockbrokers.

And it didn’t take me long to find out that most of them were ripping him off.

No, they weren’t stealing his money.

But they were playing the perfectly legal “carny games” for slowly taking an investor for everything he’s worth.

Wall Street’s tricks make carnival games look honest!

It didn’t take me long to realize that my dad had been suckered.

Even though he was a very smart man.

Who was very good with money.

And very savvy about business.

I figured that if Wall Street could rip off my father, they could rip off anyone.

And the more I looked into it …

The more I realized that is EXACTLY the case.

So, I fired all of my father’s brokers and decided to go it alone.

I bought or borrowed nearly every book I could find on how to invest in the stock market.

And I burned the midnight oil studying those books while still keeping my job on the news desk at the Times.

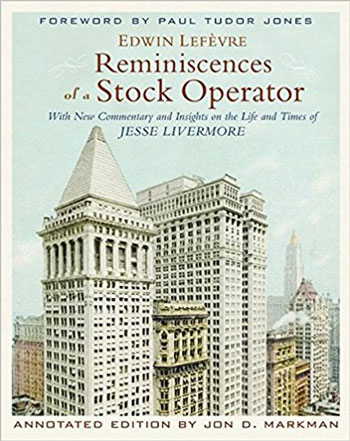

One book, in particular, had a major impact on me.

The book was called:

“Reminiscences of a Stock Operator.”

Livermore’s advice? “Don’t be a sucker!”

It was the story of the greatest stock trader of all time:

Jesse Livermore.

During the course of his career, Livermore made hundreds of millions of dollars in the stock market.

In 1906, he sold short after the San Francisco earthquake and made $250,000 — or about $6 million dollars today.

A year later, he made a million dollars in the Panic of 1907 — or roughly $24 million in today’s money.

Then in October of 1929, Livermore shorted the market before the crash and made nearly $100,000,000 in just seven days of trading.

That’s about $1.3 billion today!

But Livermore also LOST a lot of money during his career.

And he eventually came to the conclusion that the stock market was rigged against the average investor.

When Livermore sat down with his ghostwriter Edwin Lefèvre to write “Reminiscences of a Stock Operator” …

There was one message he wanted to convey above all others.

It was a message so simple it could be summed up in just four words:

Don’t be a sucker!

Livermore, in other words, wanted to give the average investor a way to fight back against the powerful forces arrayed against him.

He wanted to give people like you and me a fighting chance in the stock market …

Despite all the pitfalls, traps, and snares that have been deliberately set to take our money.

I didn’t realize it at the time, but reading “Reminiscences of a Stock Operator” would change my life.

Shortly after reading it, I decided to switch jobs.

I decided to move from the news desk of the Los Angeles Times to the Business Section.

And I did it for a simple reason:

I wanted to spend my day

studying stocks!

Plus, I wanted to get my hands on the expensive research tools the Times had for tracking the financial markets.

Wall Street sucks up your cash like a vacuum cleaner.

The more I studied this research, the more I realized that Livermore was right:

The average investor is getting played for a sucker.

And the vast majority of the stocks on the Exchange are nothing more than “sucker stocks.”

Their primary purpose?

To separate you from your money.

Chances are, YOU own some

of these stocks.

You can’t avoid it!

Even if you own mutual funds, exchange-traded funds, or index funds.

In fact, the more “diversified” your portfolio is, the more sucker stocks you own.

(In a moment, I’m going to show you a list of stocks that nearly everyone owns … and nobody should!)

You bought those stocks because you wanted to build wealth for you and your family.

But what you’ve really done is make other people rich.

How?

Here’s how Wall Street’s

“carny game” works:

It’s simple, really.

Hedge funds and other insiders are very good at finding undervalued stocks.

So, they scoop them up at bargain basement prices.

Once they’ve got a corner on these stocks, they tip off the analysts.

The analysts write glowing reports on these stocks and rate them as a “strong buy.”

Then the business media — The Wall Street Journal, CNBC, and Fox Business — jump on the bandwagon and start touting these stocks to the retail investor.

When Cramer blows his horn, is he full of hot air?

A guy like Jim Cramer, for example, rings his bell, blows his horn, and says, “You’ve got to buy this stock!”

So, millions of small investors do exactly that.

And the price goes up.

But when the stock reaches its full valuation, the hedge funds and brokers get out.

And the small investor gets left holding the bag.

It’s “pump-and-dump” …

But it’s perfectly legal.

And that’s only one of the tricks Wall Street plays on the small investor.

So, what’s your alternative?

Should you take your money out of the stock market and put it somewhere else?

Surprisingly …

NO!

I believe the stock market is still the best place to put your money to keep it safe and make it grow.

It’s better than stuffing cash in your mattress, that’s for sure.

This is what inflation gradually does to your money.

Because inflation will gradually eat away that cash like termites eat wood.

The market is better than bank accounts and CD’s, too.

Because with today’s interest rates, you’ll never get any growth in a bank.

Putting your money in T-bills, municipals, and corporate bonds used to be an option.

But thanks to the global debt crisis …

You face more risk nowadays with bonds than you do with stocks!

What about gold and silver?

Yes, gold and silver can help protect you from an economic collapse.

But if the collapse doesn’t come …

Or it doesn’t come in your lifetime …

Precious metals won’t make you a penny.

“FOR SALE: Motivated seller”

Even real estate has its drawbacks …

It’s not liquid.

You must pay taxes every year just to hang onto it.

Not to mention the money you’ll pay for upkeep, repairs, and other expenses.

And in most areas these days, real estate doesn’t give you enough growth or income to make it worth your while.

So, the stock market is still the place to be if you want to retire someday.

But not if you let yourself get played for a sucker.

You’ve got to figure out a way to turn the tables on Wall Street.

Fortunately, Jesse Livermore told us exactly how to do it:

Here are 5 ways to turn the

tables on Wall Street

-

First, don’t feel you have to swing at every pitch.

There are no “called strikes” in investing.

So, you can wait for months — or even years — for the right pitch to come along.

And in many cases, you should!

-

Second, always trade along the “line of least resistance.”

Which means in a bull market you should run with the bulls …

But in a bear market you should run with the bears.

-

Third, cut your losses but let your winners run.

The trend is your friend.

If a stock goes up, buy more.

If it goes down, sell.

-

Fourth, dip your toe in the water before you jump in.

Wait for the trend to reveal itself before you take a position.

Trying to be the first to buy or sell is a sucker move.

-

Fifth, keep your portfolio small and easy to manage.

Mark Cuban, the billionaire investor and co-host of Shark Tank, once said:

“Diversification is for idiots.”

What do billionaires, like Mark Cuban, know that most investors don’t?

What do billionaires like Mark Cuban know about investing that most of us don’t?

Building wealth is all about concentration … diligence … and focus.

It’s also about overcoming your own human nature.

Because human nature is your worst enemy when it comes to making money in the stock market.

And your best ally is the human nature of the people you’re trading against!

Still a business bestseller after nearly 100 years.

That’s why people still read and study “Reminiscences of a Stock Operator.”

In fact, I was recently asked by the publisher to create a new annotated version of this classic text:

People still read it today because Jesse Livermore didn’t always follow his own rules.

As a result, he often lost millions of dollars.

But he never made excuses.

He never wrote his losses off to “bad luck.”

He always analyzed the underlying cause of his mistakes.

And he came to a startling conclusion:

Every time he lost money it was because he let himself be swayed by his own emotions.

In other words, he fell victim to the same “sucker moves” that most investors do.

That’s why Livermore wrote “Reminiscences.”

To help the average investor take human emotion out of the trading process.

Of course, trading without emotion was nearly impossible in 1923.

But not anymore.

Because today we have something Jesse Livermore did not have.

We have a tool that can buy and sell stocks with no human emotion whatsoever:

Computers!

Computers help take human emotion out

of buying and selling stocks

In his book, Jesse Livermore said that a good trader only has four things going for him:

Observation

Experience

Memory

And mathematics

Computers can do a better job at each of these things than any human being.

As long as you give them the right instructions.

That’s what an “algorithm” is, by the way:

Just a set of instructions you give to a computer.

If the instructions are good …

Can “artificial intelligence” be used to buy and sell stocks?

The computer can follow them faster … more accurately … and more efficiently than any human being ever could.

So that’s what I was thinking when I decided to leave the Los Angeles Times and take a job with Microsoft.

Working with the software developers at Microsoft, we did something that had never been done before:

We developed a stock-screening and stock-selection system that was entirely run by computers.

In short, we were applying artificial intelligence to the process of stock selection.

We called it the StockScouter screening system.

At MSN Money, I helped create the first online system for screening stocks.

That system became the heart and soul of MSN Money, where I was the first managing editor.

But even back then I had an inkling that screening stocks was just the start of what computers could do.

So, after a few years I left Microsoft and struck out on my own.

My goal was to create a computer model that could buy and sell stocks all by itself.

I believed that by using artificial intelligence, we could “reverse engineer” Jesse Livermore …

We could duplicate the genius of history’s greatest trader to make money in today’s stock market.

But I knew that if I was going to achieve this goal, my computer model would have to do three things:

First, the model would need to

trade without emotion.

We would have let it follow the algorithms we set for it without allowing our own emotions to get in the way.

We couldn’t second-guess the algorithm or overrule it if we felt it was wrong.

We had to let it make its own decisions … its own judgments … and, yes, even its own mistakes.

As long as it could learn from them.

Second, the model would need to know

when to buy and when to sell.

We would have to tell the computer how to use Jesse Livermore’s “Pivotal Point.”

Which was his trick for knowing when a stock was about to change direction.

And how to confirm that change of direction so it wouldn’t be fooled by minor pullbacks and corrections.

Third, the model would need to

find the right stocks to buy.

To do this, we simply told the computer to sift through all the large-cap stocks on the market …

And come back with the ones that met a certain set of criteria.

Like a bloodhound, we told the computer what kind of stocks to look for. Then we told it to go out and find ‘em!

It was like letting a bloodhound sniff a scrap of a prisoner’s clothing …

Then telling it to go out and bring him back.

Specifically, we built the algorithm to look for companies that could answer “yes” to these 10 questions:

- Is the company currently making money?

- Has it made a profit in at least 7 of the last 8 years?

- Does it have plenty of cash on hand?

- Does it have the right level of debt for its size?

- It its industry growing?

- Have the shareholders gotten a good return on their money?

- Has the company created any new products or services recently that might increase the value of its stock?

- Has it recently revised its earnings estimates upward?

- Are some investors selling the stock for reasons that have nothing to do with the inherent quality of the company?

- Is the stock’s price rising … but still reasonably priced?

So, we turned the computer loose to let it look for companies that met those criteria.

What it came back with shocked us …

There were very few high-flying tech stocks like Amazon, Google, or Facebook.

Not many famous blue chips like American Express, Johnson & Johnson, or McDonald’s.

No darlings of the moment like Snap, Twitter or Tesla.

What the computer found instead were …

The 70 strangest stocks you’ll

ever fall in love with!

Some stocks are boring … but beautiful!

And when I say strange, I really mean BORING!

These are stocks your broker will NEVER recommend to you.

You’ll NEVER hear anyone whisper about these stocks at cocktail parties.

Jim Cramer will NEVER ring his bell or blow his horn about one of these stocks on TV.

For example …

There’s a company that sells sneakers and sweat socks.

(No, it’s not Nike.)

There’s a company that makes cigarettes.

(Mostly to sell in other countries.)

There’s another that makes the parts used in hip and joint replacements.

There’s a company that processes chicken meat.

And another that hauls trash for businesses.

Sound exciting?

Not at all.

Not until you look at how much money these companies make.

How much income they throw off in dividends.

And how their stock prices go up year after year, in good markets and bad.

Then you’ll find them very exciting indeed.

So exciting that I call them …

The Power Elite!

Three keys to The Power Elite: addiction, monopoly, and necessity.

What do The Power Elite stocks have in common?

They’re in industries that may not be glamorous …

But they’re steady and reliable moneymakers.

They are often in niche markets, and they’ve gotten very good at their niche.

Their products tend to be: a) necessary; b) addictive; or c) the best in their industry.

So, they can charge higher prices than the competition.

They are mid- to - large-cap corporations …

But they run their business as if they were small, private companies:

Nimble. Thrifty. Accountable.

They have great cash flow and minimal debt.

They keep tight control on their costs.

One of the ways they do that is with cutting-edge technology.

No, they are not all technology companies.

But they’re good at using technology to keep overhead low and customer satisfaction high.

Here’s what these companies DON’T do …

Just as important as the things they do well, however, are the things they don’t do:

They never make stupid acquisitions or mergers.

They don’t expand into markets they don’t understand.

They don’t stray from their core businesses and expertise.

And they don’t pay their executives outrageous salaries.

Bottom line?

These are stocks that knock it out of the park year after year.

Let’s take a look at Domino’s Pizza, for example. (Ticker symbol: DPZ)

It may be a boring pizza, but

it’s a beautiful stock!

I personally own shares in DPZ, but it is not in our model portfolio right now because I feel that its price is too high.

But rest assured, I will recommend buying it on a pullback.

Because DPZ is a classic POWER ELITE company.

You may think their pizza is boring, but you can’t deny it’s a beautiful stock.

Nine years ago, a share of DPZ was selling for $2.61 …

Today it’s worth $190!

Which means that if you took a flyer on DPZ with $10,000 back then, you’d be sitting on $720,000 today.

If you bought $25,000 worth, you’d be retired with nearly $2 million in the bank.

And if you invested $100,000, you’d be worth $7 million today—which would put you in the top one percent of the richest people in America.

You might expect that kind of growth if you got in on the ground floor of Amazon, Facebook, or Google.

But a pizza stock?

Here’s Domino’s’ secret:

Domino’s is both a fast-food stock and a technology stock.

Because they have mastered the technology of ordering, baking, and delivering a pizza.

If you’re Domino’s customer, you barely have to think about pizza before the delivery guy knocks on your door.

Nowadays, all you have to do is think about pizza and Domino’s is knocking on your door!

Because they have automated the process of taking orders by smartphone or on the internet …

Making the pizza quickly according to your personal preferences …

And delivering it efficiently to wherever you may be.

In other words, they’ve taken all the hassle out of ordering a pizza.

In the same way Uber has taken all the hassle out of taking a taxi.

But at $190 a share, you may think DPZ has reached its full valuation.

Don’t be too sure!

Domino’s is still only a $9 billion company.

Compare that to the value of some of their fast-food competitors.

Chipotle is a $14 billion company, despite all its recent problems.

Starbucks is an $87 billion company.

Which tells me DPZ still has plenty of room to grow.

So, don’t sell Domino’s short — even if you don’t like their pizza.

Here are some other boring,

but beautiful stocks:

Stocks like Domino’s are rare.

But they’re out there if you know where to look.

And our POWER ELITE model is very good at finding them.

Some of them make products that people and businesses simply need to have.

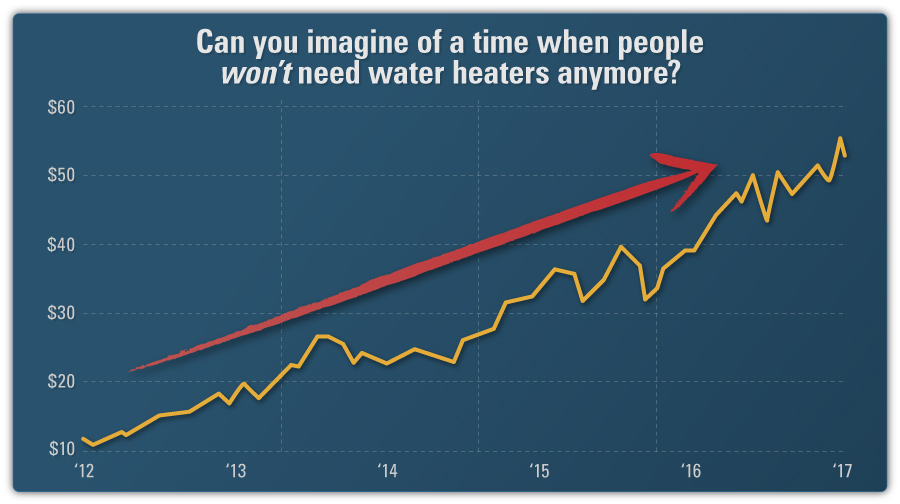

A.O. Smith, for example (Ticker Symbol: AOS), makes water heaters.

In good times or bad — no matter if the stock market is up or down — can you think of a time when homes and businesses won’t need water heaters?

That’s why AOS keeps chugging along like the little engine that could, climbing higher and higher on the charts every day.

What I’m about to say next may

not be pleasant to hear …

Some POWER ELITE companies make products that are addictive.

Which is why you find so many fast-food and “fun-food” companies among The Power Elite.

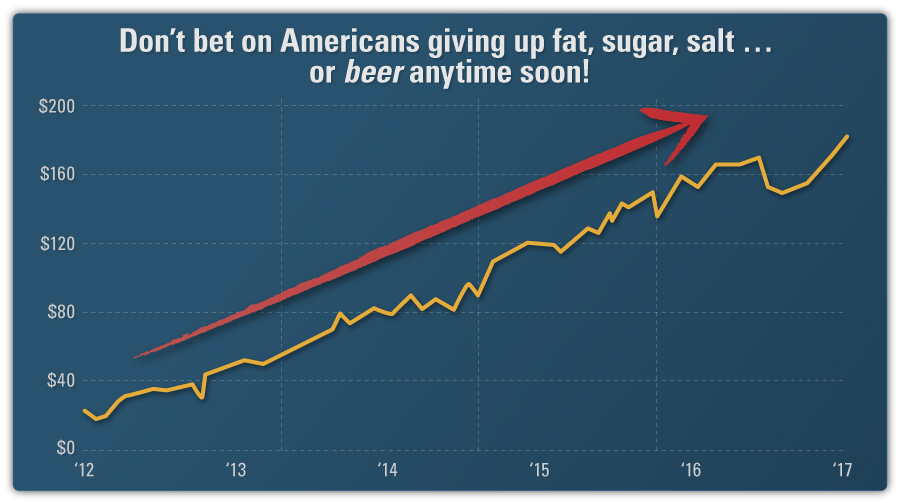

Alcoholic beverage companies like Constellation Brands, too. (Ticker: STZ)

Americans may be trying to cut down on fat, sugar, salt, and beer …

But don’t bet on it happening anytime soon!

Military contractors often have a seat among The Power Elite …

But not just the ones you know like Lockheed and Northrup Grumman.

Navy builds new ships? HII makes money. Navy gets by with old ships? HII still makes money.

Our computer model found Huntington-Ingalls (Ticker Symbol: HII) …

Which designs, builds, and repairs ships for the U.S. Navy and Coast Guard.

So, whether the Pentagon decides to build more ships in the years ahead …

Or just repair the old ones …

Huntington-Ingalls will be making money hand over fist.

But let me give you an important warning:

Do NOT buy any of these stocks now!

They’re not in our POWER ELITE portfolio now because they haven’t pulled back to a price where our signals told us to buy.

In other words, they haven’t yet reached their “Pivotal Point.”

Which was Jesse Livermore’s uncanny way of knowing when a stock — or the market as a whole — was about to change direction.

My software developers and I have programmed the “Pivotal Point” into our software.

So we always know when to buy and when to sell.

But we never jump the gun.

We always wait for validation to make sure we’re not selling on a minor correction or buying on a dead-cat bounce.

Because being right about a stock too early is just as bad as being wrong!

Here are the “Elite Eight”

Out of the 70 “stocks that don’t suck,” in fact …

There are only eight that are currently in our POWER ELITE portfolio.

Which is good news for you …

Because it’s better to own a focused portfolio of 8 stocks that make money than a “diversified” portfolio of 800 dogs.

In a moment, I’ll tell you how to find out who those 8 companies are — absolutely free — so you can buy as many shares as you want.

But first let me give you some idea of how much money you can make by investing in The Power Elite.

Because when you put The Power Elite stocks into one simple, easy-to-manage portfolio …

The results you get are nothing short of amazing.

Just take a look:

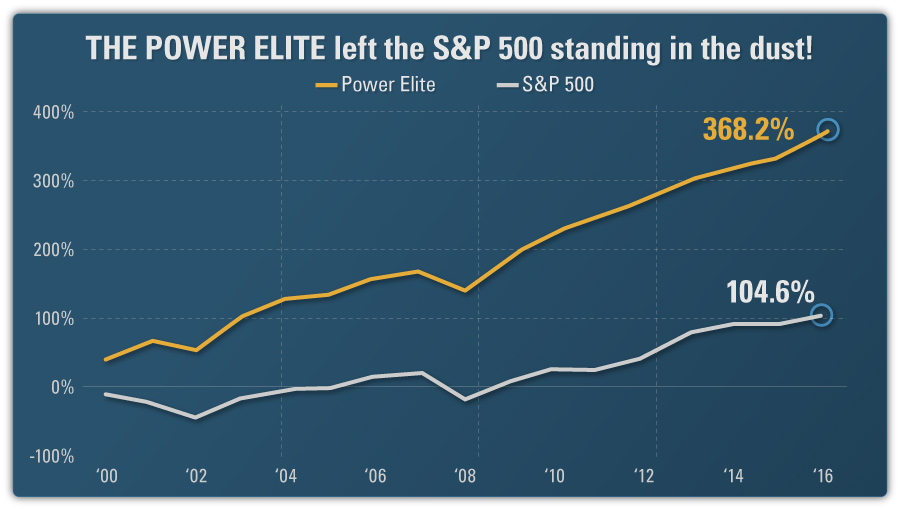

Our data of tracking The Power Elite which spans back to January of the year 2000, shows that the portfolio would have enjoyed a total compounded return of 1,084%.

That’s enough to turn a small grubstake of just $10,000 into $118,400.

Enough to turn a modest portfolio of $50,000 into $592,000.

Or turn a typical 55-year-old’s retirement nest egg of $100,000 into a whopping $1,184,000.

Take a look at the white line on this chart.

That’s the S&P 500, the benchmark of the nation’s largest 500 companies.

Now take a look at the yellow that’s shooting up like a skyrocket to the moon.

That’s based on the data from The Power Elite portfolio.

Why does it work so well?

Because 74.3% of the trades — or nearly three out of four — would have been winners.

Which means that if you’d invested in same stocks The Power Elite portfolio in 2000 …

You could’ve earned an impressive 15.6% annual return on your money.

And with a Sharpe Ratio of just 1.09 … you wouldn’t have faced much risk to do it.

The Power Elite designed to make money

in good times and bad …

The Power Elite made money in the recession of 2000 and 2001.